Crypto Market Cap Surpasses $4 Trillion: Is the Bull Run Here?

Global Crypto Market Cap Surpasses $4 Trillion for the First Time

According to data from CoinGecko and TradingView, as of July 21, 2025, the global cryptocurrency market capitalization officially exceeded $4 trillion for the first time ever. Bitcoin accounts for about 52% of this total, Ethereum makes up roughly 18%, and other altcoins—including SOL, TON, and DOGE—contribute the remaining share.

At the beginning of this year, the total crypto market cap hovered near $2.7 trillion, but it has now grown by more than 48%, with the market absorbing over $1.3 trillion in fresh capital in just six months.

ETFs and Institutional Capital Lead the Rally

In the first quarter of 2025, the U.S. SEC approved spot Bitcoin and Ethereum ETFs, both of which launched on Nasdaq and the NYSE. Within just three months, Bitcoin ETFs reached an average daily trading volume of $500 million, with BlackRock, Fidelity, and ARK among the prominent participants.

More institutions are getting involved as a growing number of pension funds, university endowments, and family offices steadily increase their exposure to crypto assets. Major financial firms—including Morgan Stanley and JPMorgan Chase—have launched proprietary crypto market indices, further enhancing investment transparency.

Stablecoin Oversight and the GENIUS Act

On July 17, 2025, the U.S. Congress passed the GENIUS Act. This legislation requires that all stablecoins offered to U.S. users be backed 1:1 by U.S. dollar reserves and undergo quarterly audits by registered public accountants. The law removed compliance overhang for stablecoins like USDC and USDT. This fueled accelerated issuance and circulation, which pushed total market capitalization higher.

For example, Circle—the issuer of USDC—announced plans to increase circulation from $32 billion to $50 billion and partnered with JPMorgan Chase for reserve custody, further strengthening confidence in the ecosystem.

Bitcoin Realized Cap vs. Circulating Market Cap

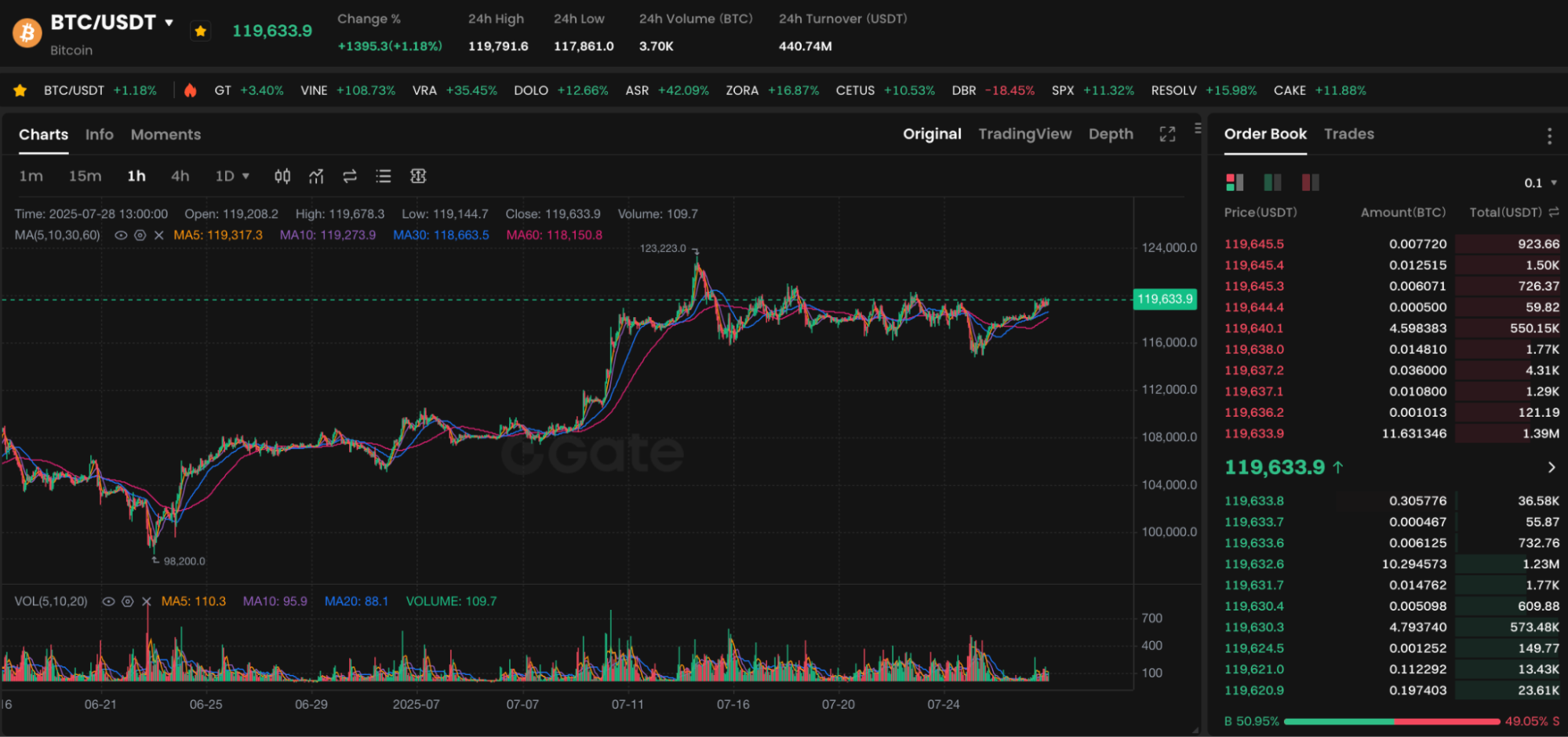

Image: https://www.gate.com/trade/BTC_USDT

Glassnode reports that by the end of July, Bitcoin’s “realized capitalization”—which measures value based on the last on-chain transaction price for each coin—exceeded $1 trillion for the first time, while circulating market cap reached about $1.28 trillion. This trend shows aggregate acquisition costs are rising, and most investors are now in profit.

On-chain analytics also show that wallets inactive for over 90 days now represent a record share. This underscores long-term holders’ strong conviction in future market prospects.

Risks Underlying Market Cap Growth

While the total cryptocurrency market cap keeps reaching new highs, significant risks remain.

- Regulatory risk: For example, the European Union has yet to clarify its specific approach to stablecoin regulation.

- Macroeconomic risk: If the Federal Reserve resumes rate hikes, risk asset valuations could come under pressure.

- On-chain risk: The altcoin bubble has yet to burst. Many projects still lack real users or practical utility.

Three Essential Tips for Crypto Newcomers

- Prioritize leading projects: Focus on BTC, ETH, SOL, and avoid making impulsive investments in new tokens.

- Manage your position sizes and leverage: Keep exposure under 20% of total assets; avoid leverage when starting out.

- Regularly monitor total market cap metrics: Use platforms like CoinGecko and TradingView to stay on top of market trends.

Share

Content