- Topic1/3

45k Popularity

26k Popularity

7k Popularity

24k Popularity

18k Popularity

- Pin

- 📢 #Gate Square Writing Contest Phase 3# is officially kicks off!

🎮 This round focuses on: Yooldo Games (ESPORTS)

✍️ Share your unique insights and join promotional interactions. To be eligible for any reward, you must also participate in Gate’s Phase 286 Launchpool, CandyDrop, or Alpha activities!

💡 Content creation + airdrop participation = double points. You could be the grand prize winner!

💰Total prize pool: 4,464 $ESPORTS

🏆 First Prize (1 winner): 964 tokens

🥈 Second Prize (5 winners): 400 tokens each

🥉 Third Prize (10 winners): 150 tokens each

🚀 How to participate:

1️⃣ Publish an

- 📢 Gate Square #TopContentChallenge# is coming! Post high-quality content and win exclusive rewards!

🌟 We will select outstanding posts for exposure, and help elevate your influence!

💡 How to Participate?

1.Add the #TopContentChallenge# tag to your post.

2.Posts must be over 60 characters and receive at least 3 interactions (Likes/Comment/Share).

3.Post may include only the #TopContentChallenge# tag.

🎁 We’ll select 1 top post to win $50 Futures Voucher every Tuesday and Thursday!

📃 High-quality posts will be shared on Gate Square and labeled as [Featured Posts]!

📌 Rewards will be distribu

- 🎉 [Gate 30 Million Milestone] Share Your Gate Moment & Win Exclusive Gifts!

Gate has surpassed 30M users worldwide — not just a number, but a journey we've built together.

Remember the thrill of opening your first account, or the Gate merch that’s been part of your daily life?

📸 Join the #MyGateMoment# campaign!

Share your story on Gate Square, and embrace the next 30 million together!

✅ How to Participate:

1️⃣ Post a photo or video with Gate elements

2️⃣ Add #MyGateMoment# and share your story, wishes, or thoughts

3️⃣ Share your post on Twitter (X) — top 10 views will get extra rewards!

👉

[Forex] US Dollar/Yen Dependent on the Trump Administration - Part 2 | Yoshida Tsune's Forex Daily | Moneyクリ Moneyx Securities Investment Information and Media Useful for Money

[Exchange] US Dollar/Yen Depending on the Trump Administration - Part 1

Do not tolerate excessive yen depreciation and unjustifiably low interest rates = A warning to Japan

At the time when the U.S. Treasury Department released its currency report in June, Treasury Secretary Yellen made a statement that included the following passage: "The Trump administration has warned trade partners and regions that it will no longer tolerate macroeconomic policies that promote an unbalanced trade relationship with the United States."

If we were to replace "macroeconomic policies that promote an imbalanced trade relationship with the United States" in the context of Japan, it would typically look like the following: "The Trump administration has warned Japan that it will no longer tolerate excessive yen depreciation and unfairly low interest rates."

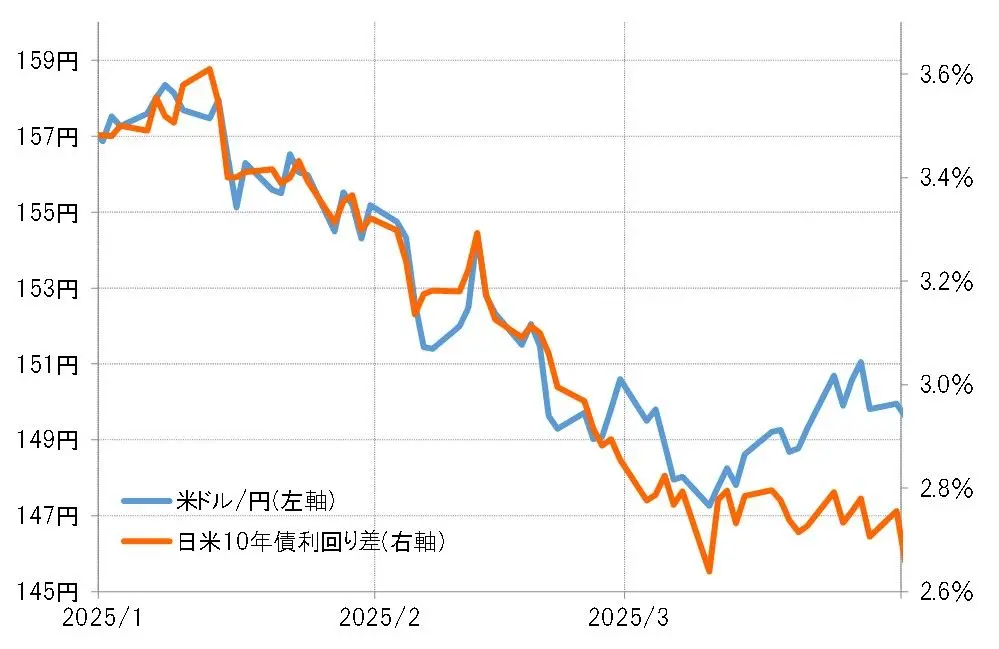

So, what actually happened? The USD/JPY fell from 158 yen in January to 146 yen in March, which was in line with the narrowing of the interest rate differential between Japan and the US (see Chart 1). What was noteworthy was the "substance" of this narrowing of the interest rate differential.

[Figure 1] USD/JPY and the US-Japan 10-Year Bond Yield Spread (January to March 2025) Source: Created by Monex Securities from data provided by Refinitiv.

The narrowing of the interest rate differential between Japan and the United States from January to March was essentially characterized by an unusual scenario where Japan's long-term interest rates, which are strongly influenced by the long-term rates in the "world's largest economy," the United States, rose significantly in late January despite a downward trend in U.S. long-term interest rates (see Figure 2). Moreover, the unusual divergence in this Japan-U.S. interest rate differential began at the end of January, which coincided with the timing of Mr. Bessent's confirmation as Secretary of the Treasury in the U.S. Senate.

Source: Created by Monex Securities from data provided by Refinitiv.

The narrowing of the interest rate differential between Japan and the United States from January to March was essentially characterized by an unusual scenario where Japan's long-term interest rates, which are strongly influenced by the long-term rates in the "world's largest economy," the United States, rose significantly in late January despite a downward trend in U.S. long-term interest rates (see Figure 2). Moreover, the unusual divergence in this Japan-U.S. interest rate differential began at the end of January, which coincided with the timing of Mr. Bessent's confirmation as Secretary of the Treasury in the U.S. Senate.

[Figure 2] Trends in 10-Year Bond Yields in Japan and the United States (September 2024 - March 2025) Source: Created by Monex Securities from data provided by Refinitiv

Mr. Bessent held online meetings with Japanese Finance Minister Kato and Bank of Japan Governor Ueda shortly after taking office as Treasury Secretary. Since then, the significant rise in Japanese interest rates has led to a narrowing of the interest rate differential between Japan and the US, resulting in a movement towards a weaker Dollar and stronger Yen.

Source: Created by Monex Securities from data provided by Refinitiv

Mr. Bessent held online meetings with Japanese Finance Minister Kato and Bank of Japan Governor Ueda shortly after taking office as Treasury Secretary. Since then, the significant rise in Japanese interest rates has led to a narrowing of the interest rate differential between Japan and the US, resulting in a movement towards a weaker Dollar and stronger Yen.

Hedge F is a "Separate Unit" = U.S. Treasury Secretary Yellen does not seem to accept a weaker Yen?

To summarize what we have seen so far, there may have been a warning from U.S. Treasury Secretary Yellen to Japan's currency and monetary policy officials in early February, stating that "the Trump administration will no longer tolerate excessive yen depreciation and unfairly low interest rates." In response, the Bank of Japan moved to guide interest rates higher, which led to a narrowing of the interest rate differential between Japan and the U.S., resulting in a weaker Dollar and stronger Yen. Hedge funds may have aggressively increased their yen purchases, which seem unreasonable from the perspective of the interest rate differential, thus playing a leading role in the weaker Dollar and stronger Yen. Given that Treasury Secretary Yellen comes from the hedge fund industry, it seems likely that the two may have collaborated.

As April began, when U.S. President Trump announced reciprocal tariffs, stock prices globally plummeted in what was termed the "tariff shock," further leading to a situation of "selling the U.S. dollar," causing the Dollar/Yen to fall below 140 yen. In this context, Secretary Bessent was reported to have expressed concerns about a "U.S. dollar crisis."

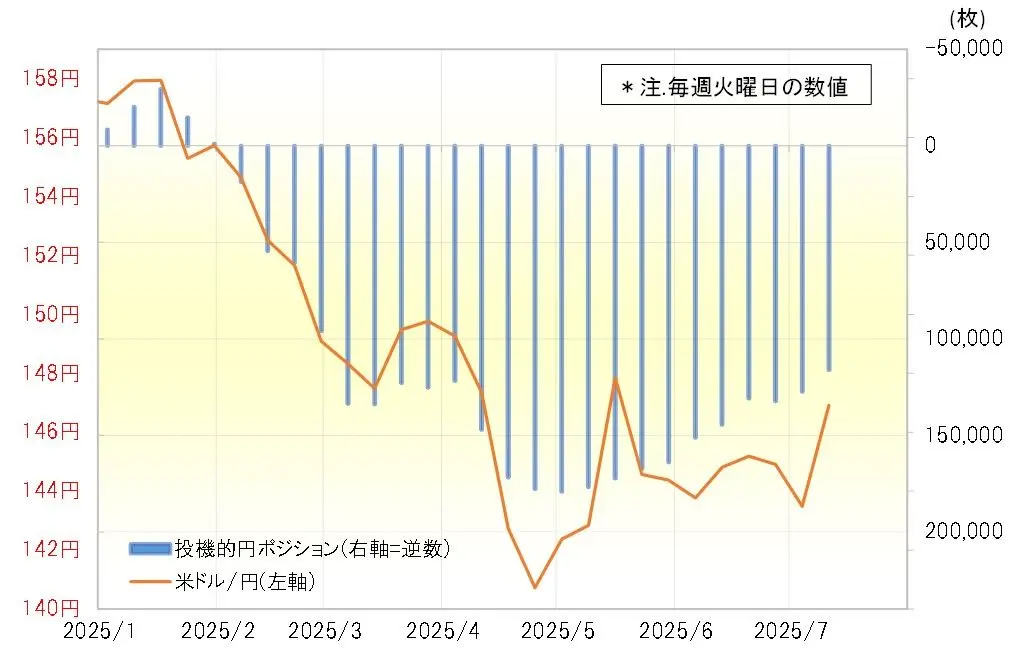

In this context, the expansion of speculative selling of the Dollar and buying of the Yen in CFTC statistics has leveled off (see Chart 3). Based on what we have seen so far, it is possible that Secretary Bessent's request for hedge funds to exercise restraint in selling the Dollar, which hedge funds complied with, was one factor in avoiding a Dollar crisis.

[Figure 3] CFTC statistics on speculative yen positions and USD/JPY (from January 2025 onward) Source: Created by Monex Securities from Refinitiv data.

Looking at it this way, it seems that the USD/JPY has been developing almost according to the scenario of U.S. Treasury Secretary Mnuchin since the Trump administration began. Secretary Mnuchin has warned Japan that "the Trump administration will no longer tolerate excessive yen depreciation and unjustifiably low interest rates." If that is the case, the return to a stronger USD and weaker yen is likely to be limited.

Source: Created by Monex Securities from Refinitiv data.

Looking at it this way, it seems that the USD/JPY has been developing almost according to the scenario of U.S. Treasury Secretary Mnuchin since the Trump administration began. Secretary Mnuchin has warned Japan that "the Trump administration will no longer tolerate excessive yen depreciation and unjustifiably low interest rates." If that is the case, the return to a stronger USD and weaker yen is likely to be limited.