更多

- 话题1/3

2k 热度

600 热度

13k 热度

21k 热度

15k 热度

- 置顶

- 🎉Gate 2025 上半年社区盛典:内容达人评选投票火热进行中 🎉

🏆 谁将成为前十位 #Gate广场# 内容达人?

投票现已开启,选出你的心头好

🎁赢取 iPhone 16 Pro Max、限量周边等好礼!

📅投票截止:8 月 15 日 10:00(UTC+8)

立即投票: https://www.gate.com/activities/community-vote

活动详情: https://www.gate.com/announcements/article/45974

- 📢 #Gate广场征文活动第二期# 正式启动!

分享你对 $ERA 项目的独特观点,推广ERA上线活动, 700 $ERA 等你来赢!

💰 奖励:

一等奖(1名): 100枚 $ERA

二等奖(5名): 每人 60 枚 $ERA

三等奖(10名): 每人 30 枚 $ERA

👉 参与方式:

1.在 Gate广场发布你对 ERA 项目的独到见解贴文

2.在贴文中添加标签: #Gate广场征文活动第二期# ,贴文字数不低于300字

3.将你的文章或观点同步到X,加上标签:Gate Square 和 ERA

4.征文内容涵盖但不限于以下创作方向:

ERA 项目亮点:作为区块链基础设施公司,ERA 拥有哪些核心优势?

ERA 代币经济模型:如何保障代币的长期价值及生态可持续发展?

参与并推广 Gate x Caldera (ERA) 生态周活动。点击查看活动详情:https://www.gate.com/announcements/article/46169。

欢迎围绕上述主题,或从其他独特视角提出您的见解与建议。

⚠️ 活动要求:

原创内容,至少 300 字, 重复或抄袭内容将被淘汰。

不得使用 #Gate广场征文活动第二期# 和 #ERA# 以外的任何标签。

每篇文章必须获得 至少3个互动,否则无法获得奖励

鼓励图文并茂、深度分析,观点独到。

⏰ 活动时间:2025年7月20日 17

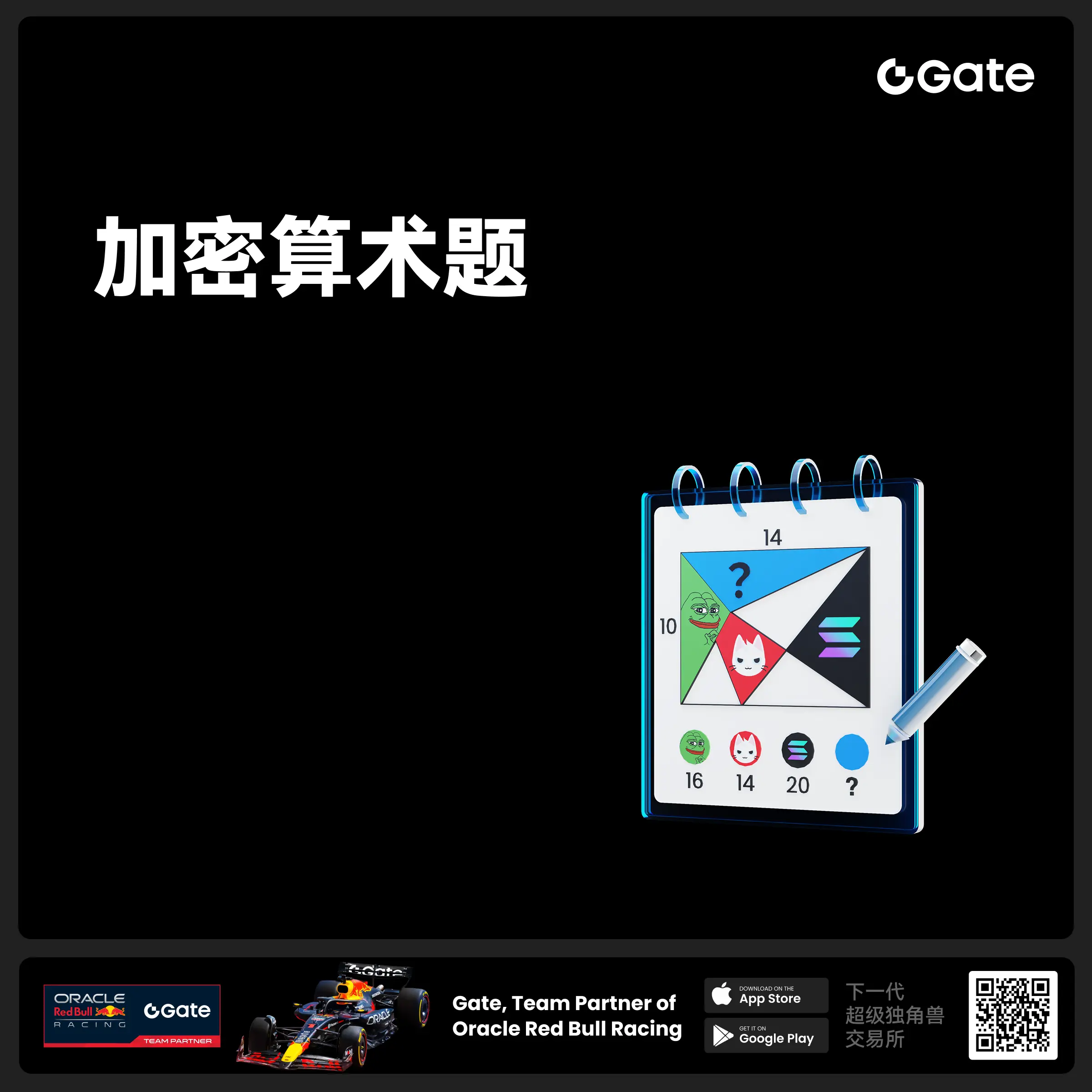

- 🧠 #GateGiveaway# - 加密算术题挑战!

你能解出这道加密题吗?

💰 $10 合约体验券 * 4 位获奖者

参与方式:

1️⃣ 关注 Gate广场_Official

2️⃣ 点赞此条动态贴文

3️⃣ 在评论中留下你的答案

📅 截止时间:7 月 22 日 12:00(UTC+8)

- 📢 ETH冲击4800?我有话说!快来“Gate广场”秀操作,0.1 ETH大奖等你拿!

牛市预言家,可能下一个就是你!想让你的观点成为广场热搜、赢下ETH大奖?现在就是机会!

💰️ 广场5位优质发帖用户+X浏览量前5发帖用户,瓜分0.1 ETH!

🎮 活动怎么玩,0门槛瓜分ETH!

1.话题不服来辩!

带 #ETH冲击4800# 和 #ETH# 在 广场 或 K线ETH下 围绕一下主题展开讨论:

-ETH是否有望突破4800?

-你看好ETH的原因是什么?

-你的ETH持仓策略是?

-ETH能否引领下一轮牛市?

2. X平台同步嗨

在X平台发帖讨论,记得带 #GateSquare# 和 #ETH冲击4800# 标签!

把你X返链接提交以下表单以瓜分大奖:https://www.gate.com/questionnaire/6896

✨发帖要求:

-内容须原创,字数不少于100字,且带活动指定标签

-配图、行情截图、分析看法加分,图文并茂更易精选

-禁止AI写手和灌水刷屏,一旦发现取消奖励资格

-观点鲜明、逻辑清晰,越有料越好!

关注ETH风向,创造观点价值,从广场发帖开始!下一个牛市“预言家”,可能就是你!🦾🏆

⏰ 活动时间:2025年7月18日 16:00 - 2025年7月28日 23:59(UTC+8)

【立即发帖】 展现你的真知灼见,赢取属于你的ETH大奖!

- 🎉【Gate 3000万纪念】晒出我的Gate时刻,解锁限量好礼!

Gate用户突破3000万!这不仅是数字,更是我们共同的故事。

还记得第一次开通账号的激动,抢购成功的喜悦,或陪伴你的Gate周边吗?

📸 参与 #我的Gate时刻# ,在Gate广场晒出你的故事,一起见证下一个3000万!

✅ 参与方式:

1️⃣ 带话题 #我的Gate时刻# ,发布包含Gate元素的照片或视频

2️⃣ 搭配你的Gate故事、祝福或感言更佳

3️⃣ 分享至Twitter(X)可参与浏览量前10额外奖励

推特回链请填表单:https://www.gate.com/questionnaire/6872

🎁 独家奖励:

🏆 创意大奖(3名):Gate × F1红牛联名赛车模型一辆

👕 共创纪念奖(10名): 国际米兰同款球员卫衣

🥇 参与奖(50名):Gate 品牌抱枕

📣 分享奖(10名):Twitter前10浏览量,送Gate × 国米小夜灯!

*海外用户红牛联名赛车折合为 $200 合约体验券,国米同款球衣折合为 $50 合约体验券,国米小夜灯折合为 $30 合约体验券,品牌抱枕折合为 $20 合约体验券发放

🧠 创意提示:不限元素内容风格,晒图带有如Gate logo、Gate色彩、周边产品、GT图案、活动纪念品、活动现场图等均可参与!

活动截止于7月25日 24:00 UTC+8

3

Blockchain compliance tools can slash TradFi costs — Chainlink co-founder

Blockchain-based investment products and compliance tools are poised to become more than 10 times faster and cheaper than traditional finance (TradFi) offerings, spurring increased digital asset adoption among financial institutions.

Traditional financial compliance products are often fragmented and expensive due to complex manual processes, resulting in billions of dollars in costs for institutions.

“Compliance is an inefficient part of the traditional finance industry that a lot of people are not happy about, including identity verification of AML and KYC,” Chainlink co-founder Sergey Nazarov told Cointelegraph during the RWA Summit 2025 in Cannes.

“If you compare what it costs and how complicated it is to make a compliant transaction in the TradFi world, our industry should be able to do it ten times faster and cheaper,” he said. “It’s like a huge cost problem for the TradFi industry.”

Nazarovc added that solving this inefficiency could “unblock a bunch of institutions from being able to put capital onchain.”

Chainlink launches Automated Compliance Engine

On June 30, Chainlink revealed its Automated Compliance Engine (ACE), a system that provides a modular and standardized framework for managing regulatory compliance across both traditional and decentralized finance (DeFi) protocols.

ACE is in early access for select institutions and aims to unlock $100 trillion worth of new capital to enter the blockchain economy, according to Chainlink.

Related: Bitcoin becomes 5th global asset ahead of “Crypto Week,” flips Amazon: Finance Redefined

RWAs could become cheaper than traditional assets

Thanks to the efficiencies of blockchain technology, investing in traditional assets such as equities and commodities will become cheaper through real-world asset (RWA) tokenization.

This could inspire increasingly more institutions to adopt RWA-based investments, Nazarov said, adding:

Chainlink’s ACE framework supports launching tokenized RWAs with built-in compliance, potentially lowering the friction and cost for institutional investors entering blockchain markets.

Related: Bitcoin whale’s $9.6B transfer, GENIUS Act spark correction concerns

“It’s meant to reduce the friction and the cost of institutional capital doing transactions on blockchains,” Nazarov said.

Magazine: Will Robinhood’s tokenized stocks REALLY take over the world? Pros and cons