A quick look at Yala, the upcoming TGE, is Solana the leader in BTCFi?

The native liquidity protocol Yala announced its Season 1 airdrop details last night, which will open for airdrop claims on the day of TGE. After launching on the Solana mainnet in May, the Solana Chinese community revealed that Yala will soon have its TGE. What is the background of Yala, what is the protocol’s principle, how will Season 1 be allocated, and how can one participate in the future?

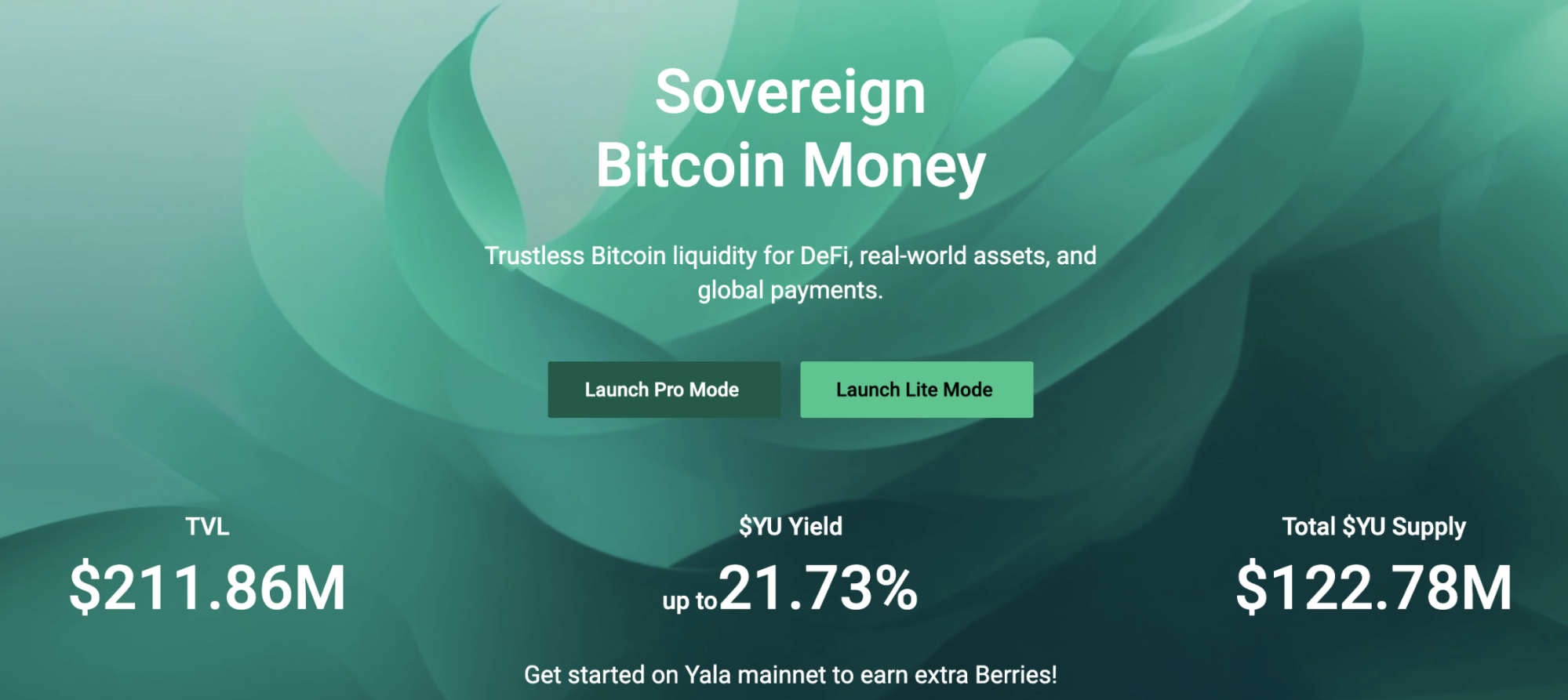

Yala is a Bitcoin-native liquidity protocol that mints the stablecoin YU by over-collateralizing BTC on the Bitcoin chain, linking the value of Bitcoin to multi-chain DeFi and real world asset (RWA) yields. The protocol aims to enable Bitcoin holders to participate in DeFi and RWA ecosystems without giving up ownership of their assets, thereby unlocking the long-idled value of Bitcoin.

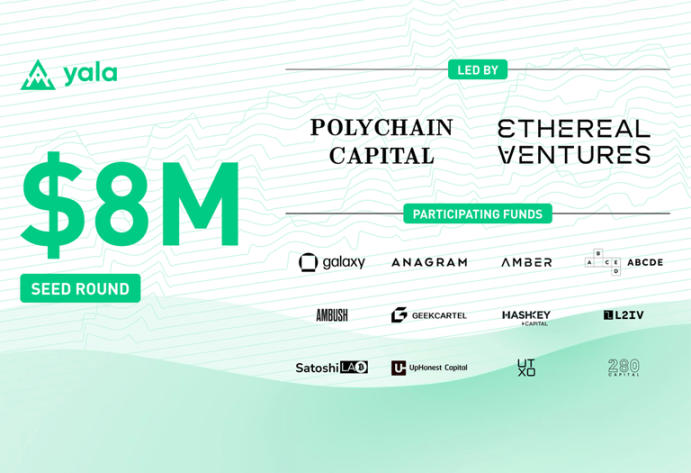

Financing situation

Yala completed its $8 million seed round financing in October 2024, co-led by Polychain Capital and Ethereal Ventures. Other participating investors included institutions such as Galaxy Vision Hill (Galaxy Digital), Amber Group, HashKey Capital, ABCDE Capital, Anagram, Ambush Capital, GeekCartel, L2 Iterative Ventures, SatoshiLab, UpHonest Capital, UTXO Management, and 280 Capital.

The team stated that this round of funding will primarily be used to expand the technology and product teams, enhance security, and support various preparations before the mainnet launch. In addition, the Yala founding team disclosed that there are already over 2,000 BTC in committed amounts for collateral liquidity in the early stages of the protocol, laying the foundation for the stable operation of the platform in its early days.

In terms of strategic cooperation, Yala has joined the Circle Alliance Program and will explore the application scenarios of USDC in the Bitcoin ecosystem together with other protocols and institutions in the future. Thanks to the collaboration with Circle, holders can exchange YU stablecoin for USDC at a 1:1 ratio, providing trust endorsement for YU by leveraging the broad acceptance and compliance of USDC.

Yala has also reached a strategic cooperation with the Bitcoin Layer 2 network Stacks, integrating YU into Stacks’ lending, staking, and insurance protocols, including Bitflow, Alex, Velar, Zest, etc., to enhance the liquidity and stability of the Stacks ecosystem. In July this year, Yala partnered with the crypto payment gateway Alchemy Pay to launch the Yeti Card, allowing Bitcoin holders to leverage YU earnings for global consumption.

Team Background

The Yala team members span across the fields of crypto and traditional finance. According to official information, the founders of Yala include a former protocol architect of MakerDAO, a former stablecoin engineer at Circle, a Microsoft cloud infrastructure expert, and a former derivatives trader at Capital One. The team also gathers talents from institutions such as Lido, Binance Labs, Circle, Microsoft, and Alchemy Pay. Among them, co-founder and COO Kai-Tai Chan has previously worked at Binance and APX Finance, with an MBA background from Harvard Business School and extensive entrepreneurial experience.

Protocol Features

Yala adopts a modular design, with the core divided into several interrelated parts: Yala Bridge, Yala Network (MetaMint), and different user modes.

First, users deposit BTC through Yala Bridge and convert it into yBTC, which is a tokenized representation of Bitcoin (similar to wrapped tokens, but generated within the Yala ecosystem itself), serving as collateral for subsequent operations. After receiving yBTC, users can directly mint the YU stablecoin on the target chain (such as Ethereum, Solana, etc.) through the MetaMint module, and participate in staking, lending, and other DeFi activities across chains.

MetaMint simplifies the cross-chain process — users can deposit BTC at once and receive YU on other chains with a “one-click” solution, without the need to first exchange for stablecoins on an exchange. Additionally, Yala offers a Lite Mode for regular users and a Pro Mode for professional users. Regular users can simplify operations and achieve stable returns, while professional users can access advanced DeFi structured products such as Babylon and Ethena, obtaining additional returns while maintaining BTC exposure.

Yala’s stablecoin YU is pegged to the US dollar and is fully backed by Bitcoin. Compared to traditional centralized stablecoins, YU offers multi-chain compatibility and a revenue-sharing mechanism: it can be used on various chains such as Ethereum and Solana, and generates income for holders through activities like staking and lending. YU’s stability is maintained through multiple measures such as over-collateralization, stable fees, and liquidation mechanisms. Unlike many stablecoins that rely on third-party custody, Yala distributes system revenues to YU holders, allowing them to truly earn income from the protocol’s operations.

In terms of design philosophy, Yala emphasizes a balance between decentralization and security. It is based on the most resilient off-chain state of Bitcoin, introduces programmability through the Ordinals protocol, and ensures security through mechanisms such as a federated indexer network and multi-signature vaults. This means that Yala does not require centralized custody of BTC assets, but instead uses a decentralized indexer network to record the states of yBTC and YU off-chain, allowing for further decentralization in the future.

The team claims that the core of the Yala protocol is “true self-sovereignty”: all BTC is always stored on the Bitcoin mainnet, allowing users to maintain self-custody and thus avoid centralized risks. The project officially summarizes its three pillars as: security (BTC does not go off-chain, trust-minimized architecture), institutional-grade channels (RWA yield opportunities open to both institutions and retail investors), and transparent risk management (auditable collateral and strategies).

In terms of user experience and ecological integration, Yala also has many innovative highlights. For example, it has launched the PayFi Universe concept, allowing users to directly use Bitcoin earnings for daily consumption through the Yeti Card crypto card. The Yeti Card supports the global Visa/Mastercard network and is compatible with Apple Pay and Google Pay mobile payment methods. Users can “hold coins to earn interest and spend the interest,” allowing them to pay for coffee, shopping, and other daily expenses without selling their BTC principal.

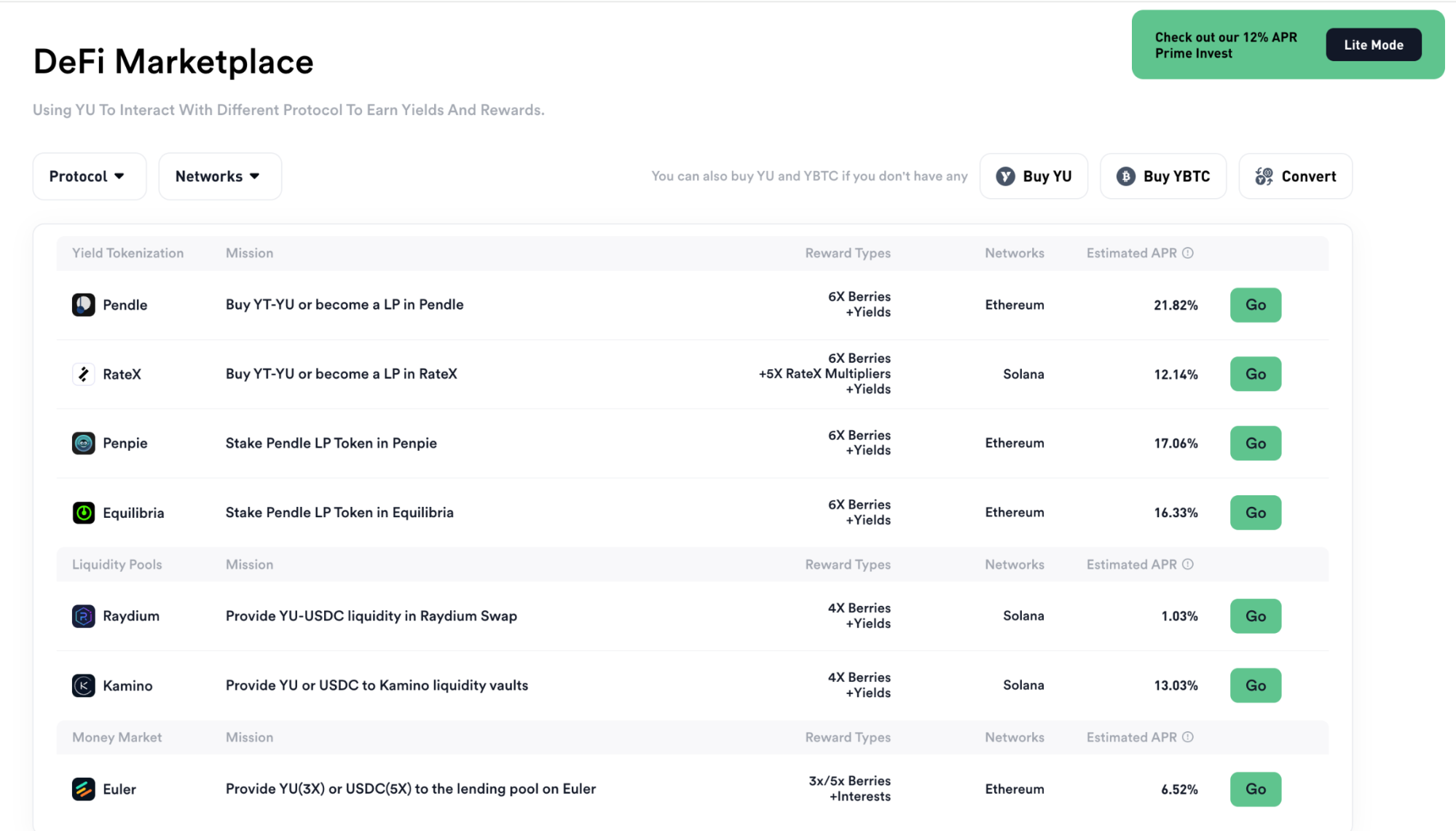

In addition, the Yala platform introduces AI yield agents (Yay-Agent), achieving 24/7 automatic income by integrating DeFi protocols and RWA products, providing users with stable annualized returns (e.g., Lite Mode fixed income 12%). Yala’s DeFi marketplace allows users to access liquidity protocols such as Raydium and Kamino on Solana across chains from the same interface, earning trading fees and compound rewards with YU, and gaining additional incentives through Berries points.

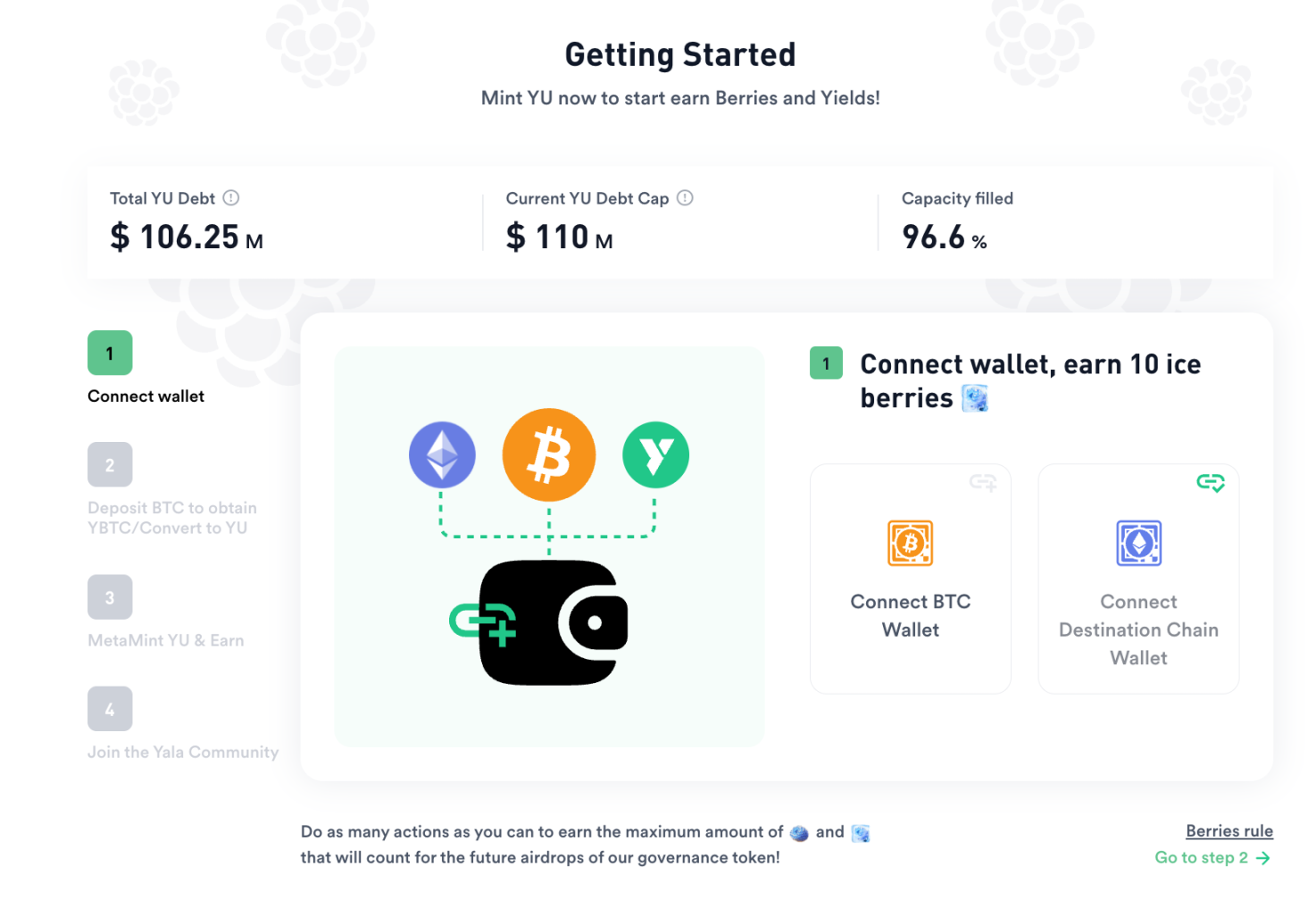

How to participate

Taking the Ethereum mainnet as an example, users can deposit Bitcoin into the protocol through the Yala Bridge gateway to obtain an equivalent tokenized Bitcoin. Then, users can use yBTC as collateral to mint YU stablecoins on Ethereum or other supported chains with one click using the MetaMint feature. Once minted, YU is directly deposited into the user’s EVM chain wallet or Solana wallet. Subsequently, users can deposit YU into the protocol’s stable pool to earn staking rewards, or provide liquidity in the DeFi market (such as investing in the YU/USDC pool on Raydium).

All on-chain activities will generate rewards - while users earn YU, they can also receive platform-provided Berries points. These points represent the user’s ecological contribution and can be used in the future to exchange for rewards or to participate in future airdrops. Currently, users can also participate in activities such as “team competitions,” forming teams to jointly participate in lotteries and further accumulate points.

Yala has launched a variety of community incentive activities, including “Yeti Yell”. Users can participate in activities, create content, or complete official tasks to earn additional rewards. At the same time, Yala has issued limited Soul-Bound Yetis NFTs as an honor certificate for early users and contributors. Currently, phase 0 of the NFT has ended, with a total of 1500 NFTs minted. Phase 1 and phase 2 will have 3000 and 5500 NFTs available for minting respectively, targeted at users and ecosystem participants ranked high in the testnet and mainnet scoring, and they have not yet been opened.

Season 1 Airdrop

The total amount of this airdrop is 34 million YALA, accounting for 3.4% of the total supply. The reward targets include participants from the mainnet and testnet, content contributors, and early supporters, with a claiming period of 1 month. The snapshot date is July 8, 2025, and the specific allocation is as follows:

Mainnet Berries contributors: 30 million YALA; Mainnet Ice Berries (social and interaction tasks) contributors: 618,000; Testnet Berries participants: 322,000; Yeti Footprints content/research/feedback/technical contributors: 3 million; Yala Bonus Rewards special reward pool for early supporters: 60,000. Users can check their eligibility for claims on the website. Unclaimed portions will be automatically reclaimed and used for future airdrops. The second season airdrop event has already begun.

Declaration:

- This article is reproduced from [Foresight News] The copyright belongs to the original author [Alex Liu, Foresight News] If you have any objections to the reprint, please contact Gate Learn TeamThe team will process it as quickly as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team, unless otherwise mentioned.GateUnder such circumstances, it is prohibited to copy, disseminate, or plagiarize translated articles.