Ethereum’s 1.9 billion unstaking wave: profit taking or a new starting point for the ecosystem?

Whenever the market heats up, FUD is never far behind.

Today, a new development is once again making investors uneasy about ETH’s price:

Validators on the Ethereum network are entering the process to unstake their ETH.

As a prime example of the PoS (Proof of Stake) consensus mechanism, staking ETH not only secures the Ethereum network but also offers stakers additional rewards, locking up ETH liquidity in staking pools.

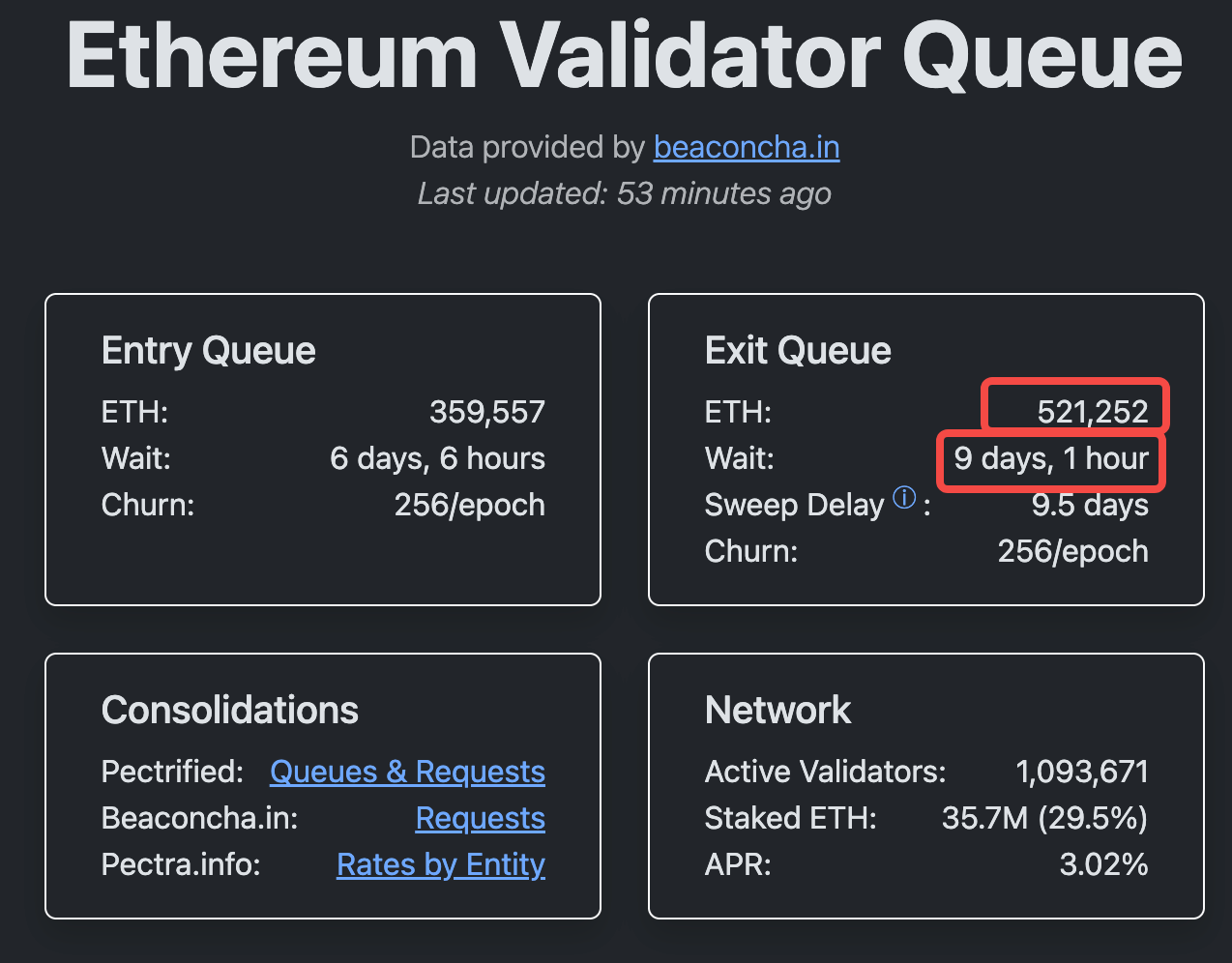

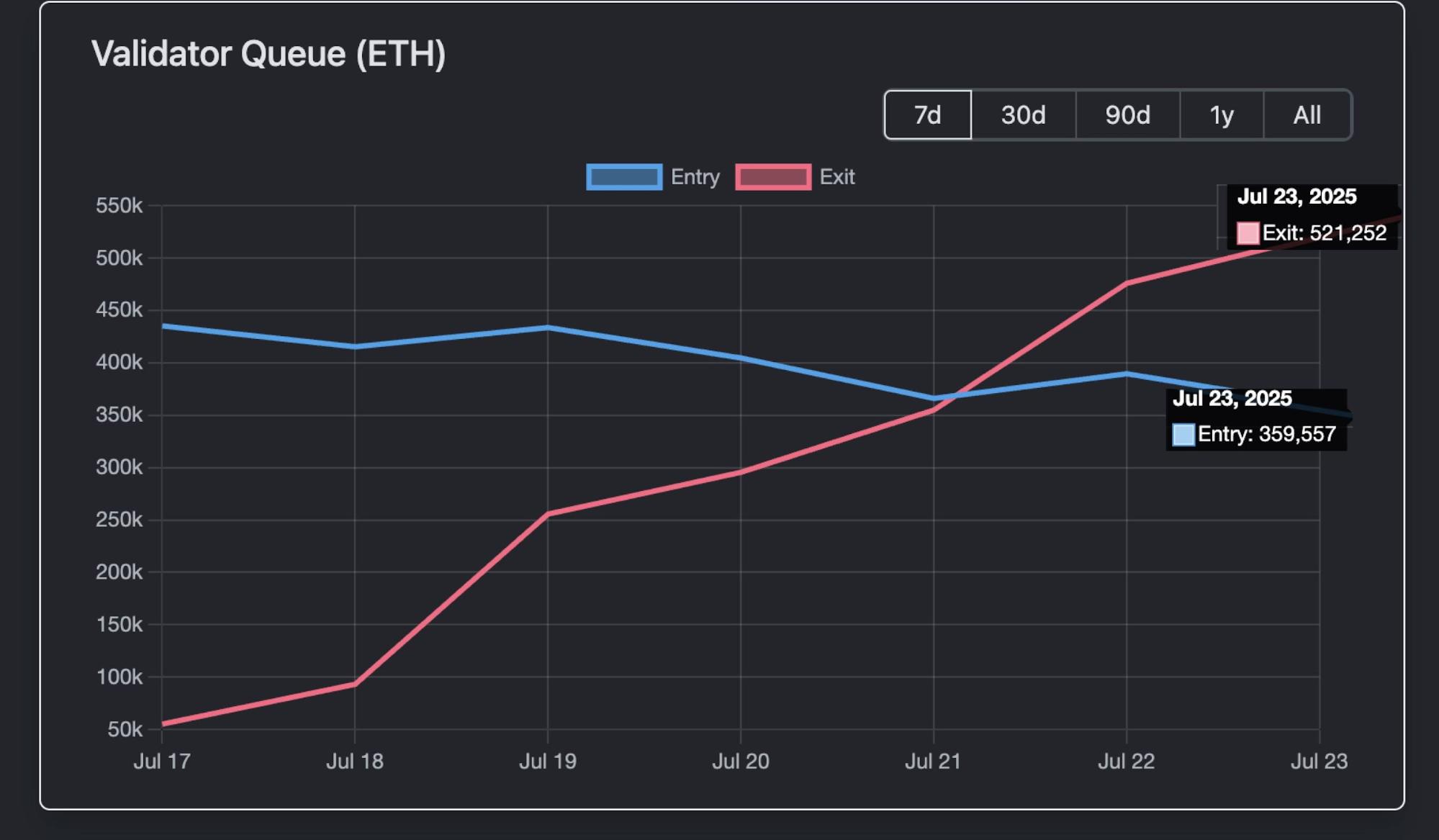

However, Validator Queue data shows that as of July 23, around 521,252 ETH—worth about $1.93 billion at current prices—are waiting in the validator exit queue to be unstaked. The expected wait time has surged to over 9 days and 1 hour.

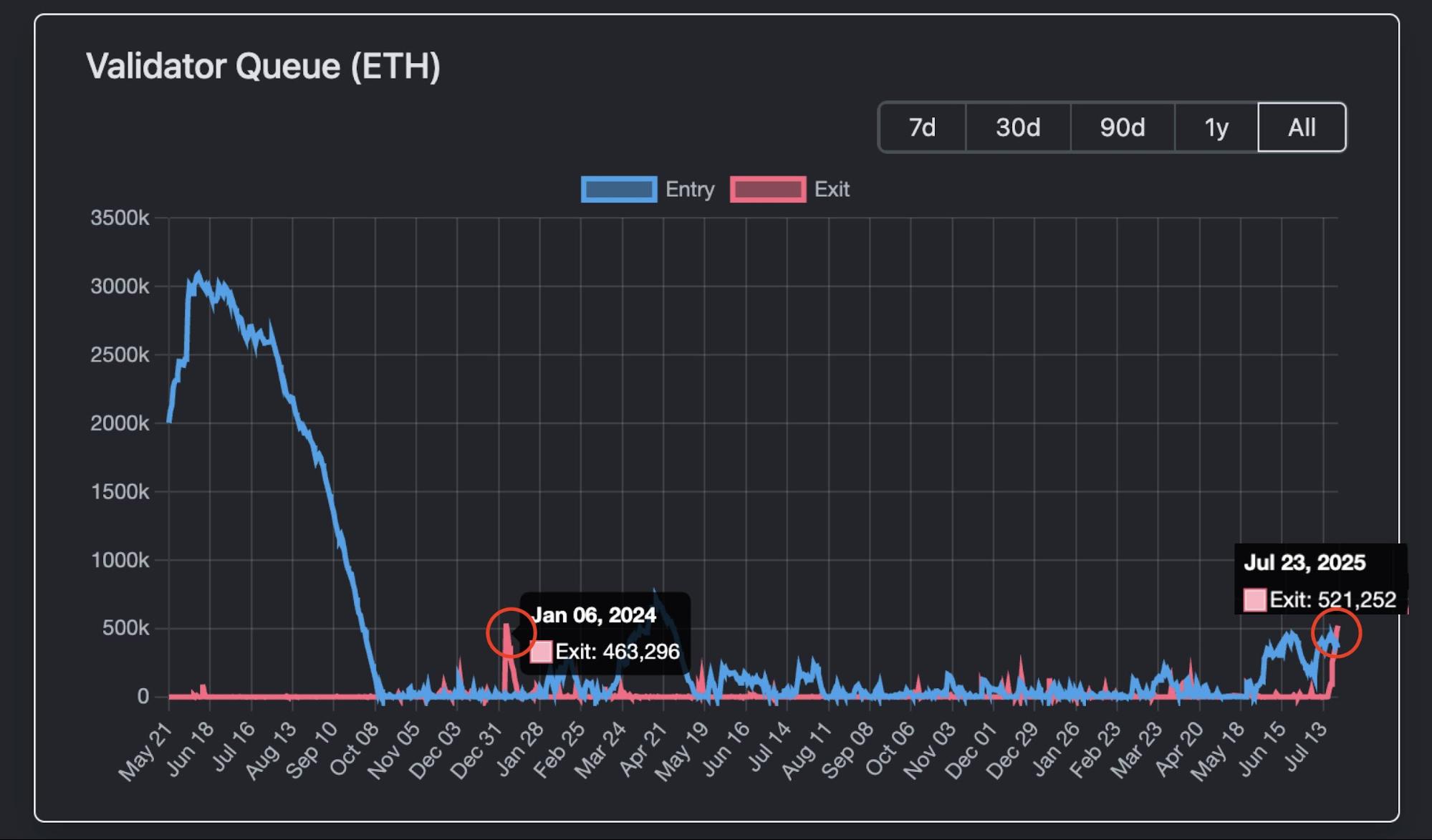

The validator exit line is at its longest point in the past year.

Given that each validator typically has 32 ETH staked, this means over 16,000 validators are now seeking to unstake. This raises concerns about potential risks associated with this large-scale withdrawal.

Profit-Taking Activity

Are whales and institutions gearing up to sell ETH and lock in profits?

The recent wave of ETH unstaking may be driven, in part, by the latest price surge.

Since its low in early April 2025 (roughly in the $1,500–$2,000 range), ETH has staged a sharp rebound—up a cumulative 160%. On July 21, ETH soared to a seven-month high of $3,812.

Rapid gains like these often trigger profit-taking, especially among early stakers who may be tempted to lock in returns rather than hold longer.

This trend has historical precedent.

For example, from January to February 2024, after the ETH/BTC ratio jumped 25% in a single week, a comparable wave of unstaking occurred—causing ETH prices to drop 10–15% in the short term. During that period, Celsius underwent bankruptcy liquidation, resulting in the rapid unstaking of 460,000 ETH. This caused approximately one week of congestion in the Ethereum validator exit queue.

No Direct Selling Pressure

However, unlike before, this long ETH exit queue and large amount of unstaking do not automatically translate to selling pressure.

According to Validator Queue data for July 23, while 520,000 ETH were queued for unstaking, 360,000 ETH were being staked simultaneously.

As a result, the net amount of ETH exiting the network drops sharply.

In addition, institutional activity is providing a safety net.

Data from July 22 shows that total net inflows across all spot ETH ETFs reached $3.1 billion—outpacing the $1.9 billion worth of ETH (520,000 coins) queued for unstaking on the same day.

This figure represents a single day’s ETF inflow. Meanwhile, validators now face a nine-day exit waiting period.

Unstaking does not necessarily indicate selling.

During ETH’s price increase, much of this concentrated unstaking is likely due to institutions shifting custodians or repositioning for treasury management, with the intention of maximizing yields rather than selling ETH.

On-chain, a significant portion of unstaked ETH may be flowing into DeFi and NFT use cases. For example, it might be supplied as collateral for liquidity, or, as seen recently, some whales have been buying up the CryptoPunks floor price.

Moreover, liquid staking tokens (LSTs) often decouple from their ETH peg (depegging), creating arbitrage opportunities. For instance, the stETH/ETH ratio recently dropped to 0.996, a 0.04% discount. weETH showed similar moves. Arbitrageurs purchase discounted LSTs and profit as the peg returns to 1:1, which increases ETH demand.

In summary, the current wave of unstaking appears to be internal capital restructuring within Ethereum’s ecosystem rather than a direct sell-off.

However, speculation is widespread on social media. While concentrated unstaking isn’t necessarily a signal of selling, it could indicate a redistribution of holdings.

Some observers argue that BlackRock—the asset management giant pushing crypto into mainstream finance—has become ETH’s de facto heavyweight. As of July, BlackRock reportedly held more than 2 million ETH (valued between $6.9 and $8.9 billion), representing roughly 1.5%–2% of the total 120 million ETH supply.

This is a transparent, ETF-driven institutional buildup. BlackRock is accumulating ETH as part of public ETF holdings, supporting broader institutional adoption rather than attempting to dominate the market.

Consequently, as Ethereum shifts from an internal crypto consensus to a universal financial instrument, it is evident that traditional financial institutions intend to play a larger role.

This theory appears plausible. Staking and unstaking may simply reflect a reallocation of positions.

Nevertheless, Ethereum’s growth prospects are expected to support its continued leadership in the cryptocurrency sector. This wave of unstaking could signal the start of a new market cycle.

Disclaimer:

- This article is reprinted from [TechFlow], with copyright belonging to the original author [TechFlow]. If you have any concerns about this reprint, please contact the Gate Learn team. Your inquiry will be addressed promptly in accordance with standard procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice of any kind.

- Other language versions of this article are translated by the Gate Learn team. Reproduction, distribution, or plagiarism of any translated version is prohibited unless Gate is explicitly cited as the source.

Share