更多

- 话题1/3

21047 热度

11700 热度

19938 热度

7500 热度

2218 热度

- 置顶

- 🎉Gate 2025 上半年社区盛典:内容达人评选投票火热进行中 🎉

🏆 谁将成为前十位 #Gate广场# 内容达人?

投票现已开启,选出你的心头好

🎁赢取 iPhone 16 Pro Max、限量周边等好礼!

📅投票截止:8 月 15 日 10:00(UTC+8)

立即投票: https://www.gate.com/activities/community-vote

活动详情: https://www.gate.com/announcements/article/45974

- 📢 #Gate广场征文活动第二期# 正式启动!

分享你对 $ERA 项目的独特观点,推广ERA上线活动, 700 $ERA 等你来赢!

💰 奖励:

一等奖(1名): 100枚 $ERA

二等奖(5名): 每人 60 枚 $ERA

三等奖(10名): 每人 30 枚 $ERA

👉 参与方式:

1.在 Gate广场发布你对 ERA 项目的独到见解贴文

2.在贴文中添加标签: #Gate广场征文活动第二期# ,贴文字数不低于300字

3.将你的文章或观点同步到X,加上标签:Gate Square 和 ERA

4.征文内容涵盖但不限于以下创作方向:

ERA 项目亮点:作为区块链基础设施公司,ERA 拥有哪些核心优势?

ERA 代币经济模型:如何保障代币的长期价值及生态可持续发展?

参与并推广 Gate x Caldera (ERA) 生态周活动。点击查看活动详情:https://www.gate.com/announcements/article/46169。

欢迎围绕上述主题,或从其他独特视角提出您的见解与建议。

⚠️ 活动要求:

原创内容,至少 300 字, 重复或抄袭内容将被淘汰。

不得使用 #Gate广场征文活动第二期# 和 #ERA# 以外的任何标签。

每篇文章必须获得 至少3个互动,否则无法获得奖励

鼓励图文并茂、深度分析,观点独到。

⏰ 活动时间:2025年7月20日 17

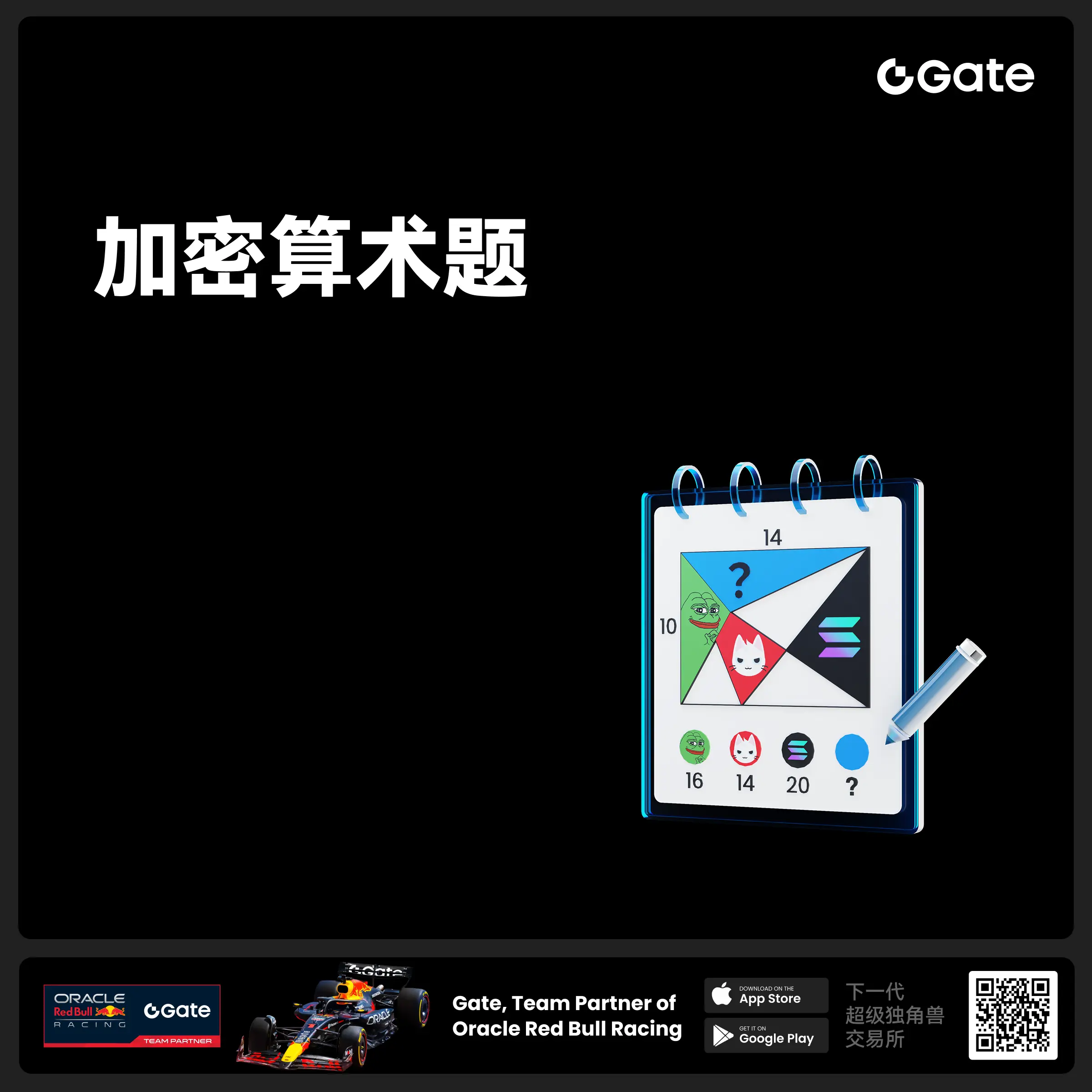

- 🧠 #GateGiveaway# - 加密算术题挑战!

你能解出这道加密题吗?

💰 $10 合约体验券 * 4 位获奖者

参与方式:

1️⃣ 关注 Gate广场_Official

2️⃣ 点赞此条动态贴文

3️⃣ 在评论中留下你的答案

📅 截止时间:7 月 22 日 12:00(UTC+8)

- 📢 ETH冲击4800?我有话说!快来“Gate广场”秀操作,0.1 ETH大奖等你拿!

牛市预言家,可能下一个就是你!想让你的观点成为广场热搜、赢下ETH大奖?现在就是机会!

💰️ 广场5位优质发帖用户+X浏览量前5发帖用户,瓜分0.1 ETH!

🎮 活动怎么玩,0门槛瓜分ETH!

1.话题不服来辩!

带 #ETH冲击4800# 和 #ETH# 在 广场 或 K线ETH下 围绕一下主题展开讨论:

-ETH是否有望突破4800?

-你看好ETH的原因是什么?

-你的ETH持仓策略是?

-ETH能否引领下一轮牛市?

2. X平台同步嗨

在X平台发帖讨论,记得带 #GateSquare# 和 #ETH冲击4800# 标签!

把你X返链接提交以下表单以瓜分大奖:https://www.gate.com/questionnaire/6896

✨发帖要求:

-内容须原创,字数不少于100字,且带活动指定标签

-配图、行情截图、分析看法加分,图文并茂更易精选

-禁止AI写手和灌水刷屏,一旦发现取消奖励资格

-观点鲜明、逻辑清晰,越有料越好!

关注ETH风向,创造观点价值,从广场发帖开始!下一个牛市“预言家”,可能就是你!🦾🏆

⏰ 活动时间:2025年7月18日 16:00 - 2025年7月28日 23:59(UTC+8)

【立即发帖】 展现你的真知灼见,赢取属于你的ETH大奖!

- 🎉【Gate 3000万纪念】晒出我的Gate时刻,解锁限量好礼!

Gate用户突破3000万!这不仅是数字,更是我们共同的故事。

还记得第一次开通账号的激动,抢购成功的喜悦,或陪伴你的Gate周边吗?

📸 参与 #我的Gate时刻# ,在Gate广场晒出你的故事,一起见证下一个3000万!

✅ 参与方式:

1️⃣ 带话题 #我的Gate时刻# ,发布包含Gate元素的照片或视频

2️⃣ 搭配你的Gate故事、祝福或感言更佳

3️⃣ 分享至Twitter(X)可参与浏览量前10额外奖励

推特回链请填表单:https://www.gate.com/questionnaire/6872

🎁 独家奖励:

🏆 创意大奖(3名):Gate × F1红牛联名赛车模型一辆

👕 共创纪念奖(10名): 国际米兰同款球员卫衣

🥇 参与奖(50名):Gate 品牌抱枕

📣 分享奖(10名):Twitter前10浏览量,送Gate × 国米小夜灯!

*海外用户红牛联名赛车折合为 $200 合约体验券,国米同款球衣折合为 $50 合约体验券,国米小夜灯折合为 $30 合约体验券,品牌抱枕折合为 $20 合约体验券发放

🧠 创意提示:不限元素内容风格,晒图带有如Gate logo、Gate色彩、周边产品、GT图案、活动纪念品、活动现场图等均可参与!

活动截止于7月25日 24:00 UTC+8

3

Bitcoin

Key Insights:

Bitcoin rebounded to $119,075 after yesterday’s pullback, while BTC dominance briefly fell below 60%. Ethereum gained 6% on continued ETF inflows, with the Altcoin Index climbing to 39. According to Coinglass, total crypto market cap reached $3.92 trillion with $348 million in liquidations.

On Monday, U.S. spot Bitcoin ETFs recorded one of the highest daily inflows in three months, totaling +7,500 BTC. On Tuesday, institutions increased exposure with an additional +3,400 BTC, bringing the two-day total to 10,900 BTC. Outflows were nearly zero, signaling growing confidence among major players.

Retail Demand Recovers as Risk Appetite Grows

Retail investors have shown early signs of a return after weeks of retreat. Data from CryptoQuant shows the 30-day change in demand for transfers under $10,000 has moved above zero. This shift indicates renewed interest in low-cap purchases and small wallet accumulation.

Altcoin strength continues, supported by the Ethereum rally and steady demand for DeFi and AI tokens. Ethereum’s price rose to $3,157, posting a 6.09% gain in 24 hours. Market breadth is improving, though dominance remains in Bitcoin’s favour for now.

Market Caution Grows as Sentiment and OI Surge

Despite bullish flows, several warning signals have emerged across technical indicators. Hyblock data shows cumulative open interest exceeding 2.2 billion, with the Fear & Greed Index at 70, reflecting “Greed.” Historically, these conditions align with local tops or consolidation phases.

Meanwhile, macro indicators show this bull market is not driven by money supply expansion like in past cycles. Coinvo’s M2 analysis shows only 12.1% global M2 growth, compared to 33% during the 2018–2021 cycle. This suggests fundamental drivers like ETF adoption and regulatory clarity are taking the lead.

| | | --- | | DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |