更多

- 话题1/3

16k 热度

4k 热度

16k 热度

25k 热度

16k 热度

- 置顶

- 🎉Gate 2025 上半年社区盛典:内容达人评选投票火热进行中 🎉

🏆 谁将成为前十位 #Gate广场# 内容达人?

投票现已开启,选出你的心头好

🎁赢取 iPhone 16 Pro Max、限量周边等好礼!

📅投票截止:8 月 15 日 10:00(UTC+8)

立即投票: https://www.gate.com/activities/community-vote

活动详情: https://www.gate.com/announcements/article/45974

- 📢 #Gate广场征文活动第二期# 正式启动!

分享你对 $ERA 项目的独特观点,推广ERA上线活动, 700 $ERA 等你来赢!

💰 奖励:

一等奖(1名): 100枚 $ERA

二等奖(5名): 每人 60 枚 $ERA

三等奖(10名): 每人 30 枚 $ERA

👉 参与方式:

1.在 Gate广场发布你对 ERA 项目的独到见解贴文

2.在贴文中添加标签: #Gate广场征文活动第二期# ,贴文字数不低于300字

3.将你的文章或观点同步到X,加上标签:Gate Square 和 ERA

4.征文内容涵盖但不限于以下创作方向:

ERA 项目亮点:作为区块链基础设施公司,ERA 拥有哪些核心优势?

ERA 代币经济模型:如何保障代币的长期价值及生态可持续发展?

参与并推广 Gate x Caldera (ERA) 生态周活动。点击查看活动详情:https://www.gate.com/announcements/article/46169。

欢迎围绕上述主题,或从其他独特视角提出您的见解与建议。

⚠️ 活动要求:

原创内容,至少 300 字, 重复或抄袭内容将被淘汰。

不得使用 #Gate广场征文活动第二期# 和 #ERA# 以外的任何标签。

每篇文章必须获得 至少3个互动,否则无法获得奖励

鼓励图文并茂、深度分析,观点独到。

⏰ 活动时间:2025年7月20日 17

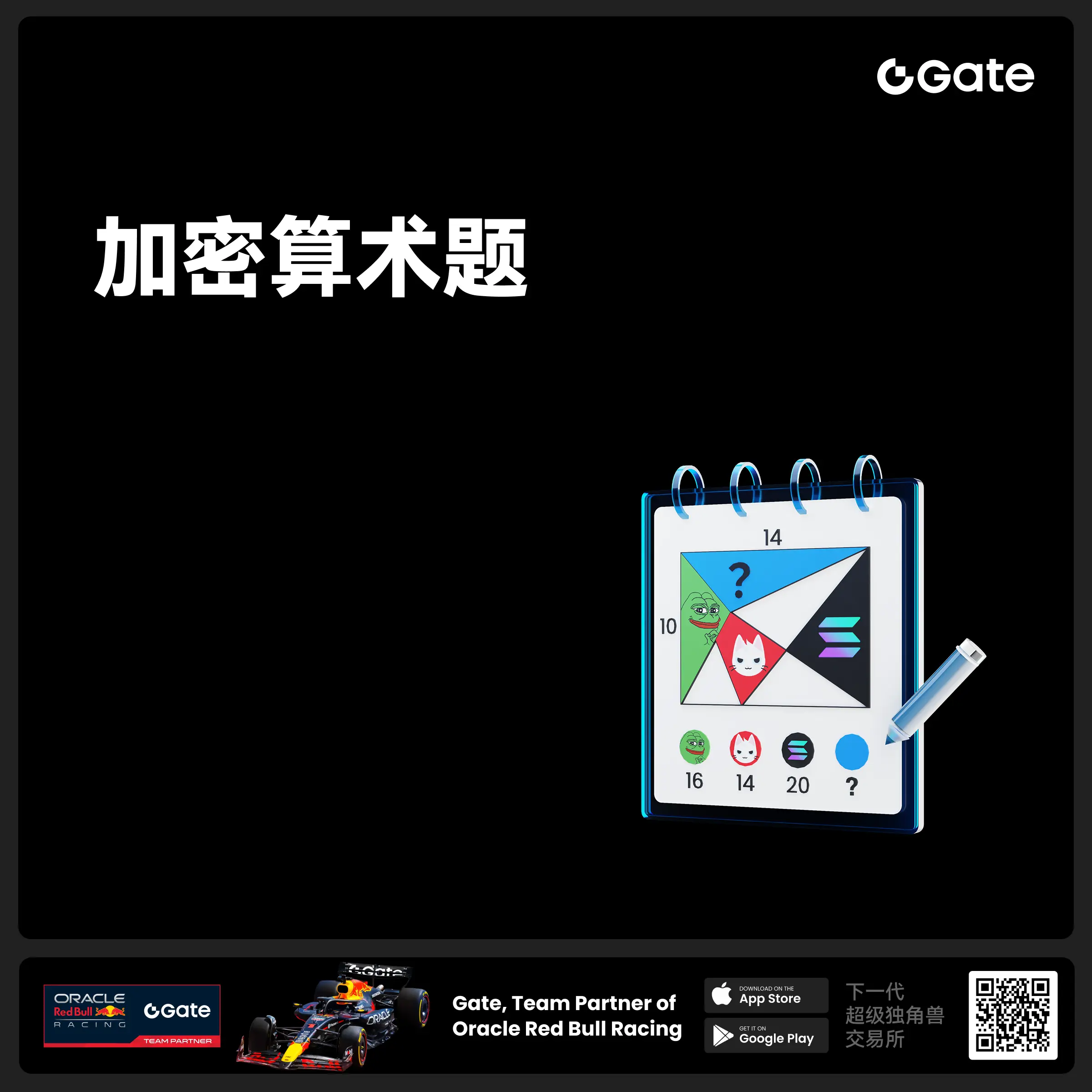

- 🧠 #GateGiveaway# - 加密算术题挑战!

你能解出这道加密题吗?

💰 $10 合约体验券 * 4 位获奖者

参与方式:

1️⃣ 关注 Gate广场_Official

2️⃣ 点赞此条动态贴文

3️⃣ 在评论中留下你的答案

📅 截止时间:7 月 22 日 12:00(UTC+8)

- 📢 ETH冲击4800?我有话说!快来“Gate广场”秀操作,0.1 ETH大奖等你拿!

牛市预言家,可能下一个就是你!想让你的观点成为广场热搜、赢下ETH大奖?现在就是机会!

💰️ 广场5位优质发帖用户+X浏览量前5发帖用户,瓜分0.1 ETH!

🎮 活动怎么玩,0门槛瓜分ETH!

1.话题不服来辩!

带 #ETH冲击4800# 和 #ETH# 在 广场 或 K线ETH下 围绕一下主题展开讨论:

-ETH是否有望突破4800?

-你看好ETH的原因是什么?

-你的ETH持仓策略是?

-ETH能否引领下一轮牛市?

2. X平台同步嗨

在X平台发帖讨论,记得带 #GateSquare# 和 #ETH冲击4800# 标签!

把你X返链接提交以下表单以瓜分大奖:https://www.gate.com/questionnaire/6896

✨发帖要求:

-内容须原创,字数不少于100字,且带活动指定标签

-配图、行情截图、分析看法加分,图文并茂更易精选

-禁止AI写手和灌水刷屏,一旦发现取消奖励资格

-观点鲜明、逻辑清晰,越有料越好!

关注ETH风向,创造观点价值,从广场发帖开始!下一个牛市“预言家”,可能就是你!🦾🏆

⏰ 活动时间:2025年7月18日 16:00 - 2025年7月28日 23:59(UTC+8)

【立即发帖】 展现你的真知灼见,赢取属于你的ETH大奖!

- 🎉【Gate 3000万纪念】晒出我的Gate时刻,解锁限量好礼!

Gate用户突破3000万!这不仅是数字,更是我们共同的故事。

还记得第一次开通账号的激动,抢购成功的喜悦,或陪伴你的Gate周边吗?

📸 参与 #我的Gate时刻# ,在Gate广场晒出你的故事,一起见证下一个3000万!

✅ 参与方式:

1️⃣ 带话题 #我的Gate时刻# ,发布包含Gate元素的照片或视频

2️⃣ 搭配你的Gate故事、祝福或感言更佳

3️⃣ 分享至Twitter(X)可参与浏览量前10额外奖励

推特回链请填表单:https://www.gate.com/questionnaire/6872

🎁 独家奖励:

🏆 创意大奖(3名):Gate × F1红牛联名赛车模型一辆

👕 共创纪念奖(10名): 国际米兰同款球员卫衣

🥇 参与奖(50名):Gate 品牌抱枕

📣 分享奖(10名):Twitter前10浏览量,送Gate × 国米小夜灯!

*海外用户红牛联名赛车折合为 $200 合约体验券,国米同款球衣折合为 $50 合约体验券,国米小夜灯折合为 $30 合约体验券,品牌抱枕折合为 $20 合约体验券发放

🧠 创意提示:不限元素内容风格,晒图带有如Gate logo、Gate色彩、周边产品、GT图案、活动纪念品、活动现场图等均可参与!

活动截止于7月25日 24:00 UTC+8

3

SEC explores Ethereum token standard for compliant securities

The US Securities and Exchange Commission (SEC) met with industry players to discuss a token standard that could support the compliant issuance and transfer of tokenized securities

The SEC’s Crypto Task Force met with Ethereum-aligned organizations last Thursday, including the ERC-3643 Association, Chainlink Labs, the Enterprise Ethereum Alliance and Linux Foundation (LF) Decentralized Trust.

During the meeting, the blockchain proponents and the SEC explored how open standards like ERC-3643 and compliance frameworks like Chainlink’s Automated Compliance Engine (ACE) can help bridge onchain technology with traditional regulatory requirements

ERC-3643 is a token standard aiming to become the foundation for compliant capital markets on the Ethereum network. It’s backed by the ERC-3643 Association and supported by companies like Chainlink. Chainlink ACE is a smart-contract-based framework for tokenized assets like securities or real-world assets (RWAs).

Dennis O’Connell, president of the ERC-3643 Association, told Cointelegraph that the SEC showed a noticeable shift in tone and approach during the meeting compared to previous years

“The Task Force was very welcoming, engaged and motivated to bring the US into leadership,” O’Connell told Cointelegraph

O’Connell said that the SEC showed openness for industry-led standards during the meeting. He told Cointelegraph that the task force had not previously considered the importance of open standards in blockchain

“We laid out our case on why, like other industries, including traditional finance, standards are fundamental to growing crypto in the US and enabling securities to come onchain,” O’Connell added

In the meeting, industry representatives presented proposals on all key elements of a regulatory framework for tokenized securities. This includes identity, compliance, registry and control

O’Connell told Cointelegraph that the task force did not take a definitive stance on tokenized securities during the meeting. However, he said they were “open to understanding how new technologies in blockchain meet concerns around identity, control and compliance.”

O’Connell said the meeting resulted from months of behind-the-scenes work, but ultimately resulted in a “major step for the industry.”

He said the ERC-3643 Association and its partners plan to continue engaging with the SEC Crypto Task Force and other US government agencies, with hopes that the US will catch up with global regulation and eventually lead in blockchain adoption for capital markets

Related: Ethereum is scaling: TPS, gas limit up as validators back 45M target

SEC Chair Atkins on boosting tokenization

The meeting was followed by positive remarks from the SEC’s head, signaling support for tokenization in the US

On Friday, Bloomberg reported that SEC Chair Paul Atkins is considering the creation of an innovation exemption within its framework to boost tokenization.

Atkin said the SEC was considering changes that would promote tokenization, including an exception that would allow new trading methods to support tokenized securities development

“If it can be tokenized, it will be tokenized,” Atkins said, recognizing that the movement of assets to the blockchain is inevitable

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs — Inside story