ChapterOfSelf-Narratio

No content yet

ChapterOfSelf-Narratio

Satsuma: The "Node Factory" Bought Out by Major Institutions

In this round of Modular heat, there is a low-key project @Satsuma_UK, a "Node as a Service" platform that specializes in modular blockchain infra.

Supports modular architectures such as Celestia, Polygon, ZK Stack, and Arbitrum Orbit. A single SDK can help the chain handle indexer, RPC, data mirroring, and even deploy a complete infra with one click.

♦️ The positioning is very clear:

It's not about building chains or middleware, but rather filling in a bunch of pitfalls that all AppChains encounter when dealing with infra, especiall

View OriginalIn this round of Modular heat, there is a low-key project @Satsuma_UK, a "Node as a Service" platform that specializes in modular blockchain infra.

Supports modular architectures such as Celestia, Polygon, ZK Stack, and Arbitrum Orbit. A single SDK can help the chain handle indexer, RPC, data mirroring, and even deploy a complete infra with one click.

♦️ The positioning is very clear:

It's not about building chains or middleware, but rather filling in a bunch of pitfalls that all AppChains encounter when dealing with infra, especiall

- Reward

- like

- Comment

- Share

A dog is floating in the sky.

Tai Ri Tian?

View OriginalTai Ri Tian?

- Reward

- like

- Comment

- Share

How to preserve attention on-chain, record behavior, and turn AI calls into "measurable economic actions."

📦The current event performance is good:

1. Occupy 1.7% mindshare

2. Emotional indicator surged +117.94K

3. Snap numbers approach 10,000

These Snap are not just fun; they are actually an on-chain behavior archiving system that OpenLedger is building: combining Snapboard to achieve the binding of behavior, identity, and assets, while leaving a trace for accounting.

The key is — this is not a fake on-chain.

It runs on the newly launched API suite of OpenLedger:

♦️Spend Tracking API: Each ti

📦The current event performance is good:

1. Occupy 1.7% mindshare

2. Emotional indicator surged +117.94K

3. Snap numbers approach 10,000

These Snap are not just fun; they are actually an on-chain behavior archiving system that OpenLedger is building: combining Snapboard to achieve the binding of behavior, identity, and assets, while leaving a trace for accounting.

The key is — this is not a fake on-chain.

It runs on the newly launched API suite of OpenLedger:

♦️Spend Tracking API: Each ti

INFRA-0.25%

- Reward

- like

- Comment

- Share

Recall × Sapien: on-chain AI needs human teaching and human evaluation.

Who will teach? Who will evaluate? Who says it learns well?

♦️ The role of Sapien is simple but crucial:

Improve the credibility and transparency of on-chain AI training through high-quality annotated data.

Who marked what and whether there is a judgment basis can all be recorded on-chain, becoming part of the reputation of the Agent.

♦️ What does this mean for Recall?

Recall itself already has AgentRank, which can track each Agent's trading judgments and execution results;

Now, adding the training records and annotation s

Who will teach? Who will evaluate? Who says it learns well?

♦️ The role of Sapien is simple but crucial:

Improve the credibility and transparency of on-chain AI training through high-quality annotated data.

Who marked what and whether there is a judgment basis can all be recorded on-chain, becoming part of the reputation of the Agent.

♦️ What does this mean for Recall?

Recall itself already has AgentRank, which can track each Agent's trading judgments and execution results;

Now, adding the training records and annotation s

AGENT1.93%

- Reward

- like

- Comment

- Share

Of course, these are just appearances; what we can see is:

Elympics is using "competition" as an entry point to turn player behavior into assets, which in turn feeds back into protocol incentives.

Players are not workers, but rather the primary input for the incentive mechanism.

Respect is the points system, Shards is the token distribution entry, and $ELP is the governance and participation credential.

Every match you participate in and every choice you make leaves a data trace on the blockchain.

This is not just a Web3 gaming experience, but more like a gradually forming game-driven on-chain

View OriginalElympics is using "competition" as an entry point to turn player behavior into assets, which in turn feeds back into protocol incentives.

Players are not workers, but rather the primary input for the incentive mechanism.

Respect is the points system, Shards is the token distribution entry, and $ELP is the governance and participation credential.

Every match you participate in and every choice you make leaves a data trace on the blockchain.

This is not just a Web3 gaming experience, but more like a gradually forming game-driven on-chain

- Reward

- like

- Comment

- Share

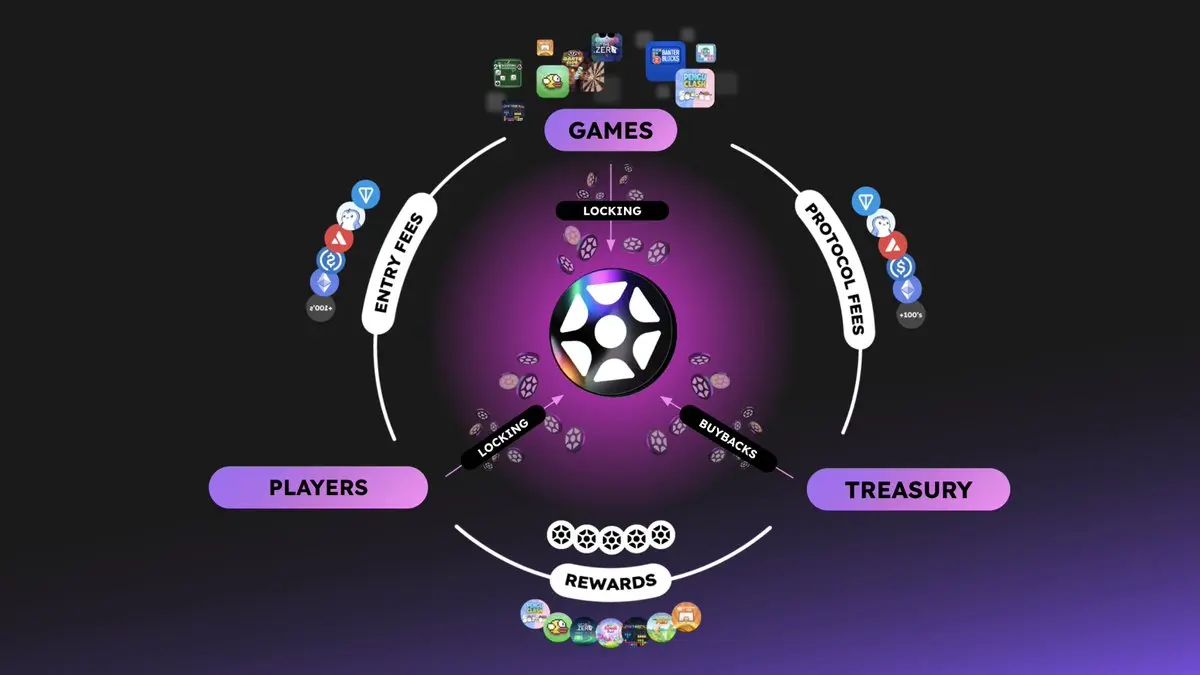

It is actually pushing the concept of "games" towards the protocol layer, making games not just a source of content or traffic, but also the central Node that connects on-chain assets, Liquidity, and incentive models, building a complete on-chain incentive system centered around games.

The recently launched Season 5 is a typical example.

♦️ Play games, complete tasks → Earn Respect

♦️ Respect is the ticket to unlock NFT Shards

♦️ Shards correspond to community round qualifications, directly related to $ELP distribution and governance.

This is not a simple task system, but rather the native use

The recently launched Season 5 is a typical example.

♦️ Play games, complete tasks → Earn Respect

♦️ Respect is the ticket to unlock NFT Shards

♦️ Shards correspond to community round qualifications, directly related to $ELP distribution and governance.

This is not a simple task system, but rather the native use

View Original

- Reward

- like

- Comment

- Share

Elympics: Turning Game Protocols into a Business

Web3 games have been around for years, and the issue of "asset ownership" has been discussed countless times, but very few have truly integrated "play freedom + value sharing."

♦️Player Side: On-chain matches, on-chain assets, and on-chain economic systems are all truly owned.

♦️Developer side: SDK + template integration, focusing on no barriers to entry, reusability, and strong compatibility.

♦️Protocol layer: asset standards unified, on-chain settlement clear, player participation in governance, revenue traceable

♦️Ecological Side: Liquidity S

Web3 games have been around for years, and the issue of "asset ownership" has been discussed countless times, but very few have truly integrated "play freedom + value sharing."

♦️Player Side: On-chain matches, on-chain assets, and on-chain economic systems are all truly owned.

♦️Developer side: SDK + template integration, focusing on no barriers to entry, reusability, and strong compatibility.

♦️Protocol layer: asset standards unified, on-chain settlement clear, player participation in governance, revenue traceable

♦️Ecological Side: Liquidity S

View Original

- Reward

- like

- Comment

- Share

[a16z Crypto Heavy Position, Bots + Decentralization AI New Player PrismaX]

Latest financing $11M seed round

Lead Investor: a16z CSX

Participating investors: Volt Capital, Symbolic, Stanford Blockchain Fund, Virtual Protocol

Fill in the most lacking infrastructure in the Bots industry.

🟥Data

Using community-driven data collection + incentive mechanisms to solve the old problem of bots relying on large companies for training data, with open standards, reusable data, and profits returned to the community.

🟥 Remote Operation

Set industry standards to solve the current issues of operational team

View OriginalLatest financing $11M seed round

Lead Investor: a16z CSX

Participating investors: Volt Capital, Symbolic, Stanford Blockchain Fund, Virtual Protocol

Fill in the most lacking infrastructure in the Bots industry.

🟥Data

Using community-driven data collection + incentive mechanisms to solve the old problem of bots relying on large companies for training data, with open standards, reusable data, and profits returned to the community.

🟥 Remote Operation

Set industry standards to solve the current issues of operational team

- Reward

- like

- Comment

- Share

Most frens have heard of it, but this time we won't talk about the PR, but rather try to understand Spark, see through it, and understand what it is really after.

It is a lending platform incubated within the MakerDAO system, but it is not a simple replication of the DAI framework.

✅ Sub-protocol based on MakerDAO

✅ Supports mainstream assets such as ETH, stETH, WBTC for collateral.

✅ Lending stablecoins: mainly DAI

✅ Supports modular access to external asset liquidity

✅ The governance structure is also lighter and more flexible.

What problems does Spark want to solve?

Everyone knows the good

View OriginalIt is a lending platform incubated within the MakerDAO system, but it is not a simple replication of the DAI framework.

✅ Sub-protocol based on MakerDAO

✅ Supports mainstream assets such as ETH, stETH, WBTC for collateral.

✅ Lending stablecoins: mainly DAI

✅ Supports modular access to external asset liquidity

✅ The governance structure is also lighter and more flexible.

What problems does Spark want to solve?

Everyone knows the good

- Reward

- like

- Comment

- Share

As a child, I used to look forward to Children's Day on June 1st every year, with games, cookies, and Candy, and no classes to attend.

Unknowingly, I have grown up and also helped my mini version celebrate Children's Day, making up for the regrets of childhood and ensuring that children have no regrets.

Entrust your trust to Gate, and also guard our assets with a big door ❤️

#GateChildrensDay # Gatecom Exchange

View OriginalUnknowingly, I have grown up and also helped my mini version celebrate Children's Day, making up for the regrets of childhood and ensuring that children have no regrets.

Entrust your trust to Gate, and also guard our assets with a big door ❤️

#GateChildrensDay # Gatecom Exchange

- Reward

- like

- Comment

- Share

Bitcoin surged to a new high, and the rhythm of the crypto market has also shifted.

The return of this market trend resembles the unveiling of a new cycle.

In this wave, inscriptions have clearly become the most significant variable in the BTC ecosystem. It doesn't rely on complex narratives or talk about future illusions, but instead uses the simplest on-chain records to pry open a new round of paradigm shifts in digital assets.

Time: 8 PM on May 25th (Sunday) Waiting for your arrival.

Link:

View OriginalThe return of this market trend resembles the unveiling of a new cycle.

In this wave, inscriptions have clearly become the most significant variable in the BTC ecosystem. It doesn't rely on complex narratives or talk about future illusions, but instead uses the simplest on-chain records to pry open a new round of paradigm shifts in digital assets.

Time: 8 PM on May 25th (Sunday) Waiting for your arrival.

Link:

- Reward

- like

- Comment

- Share

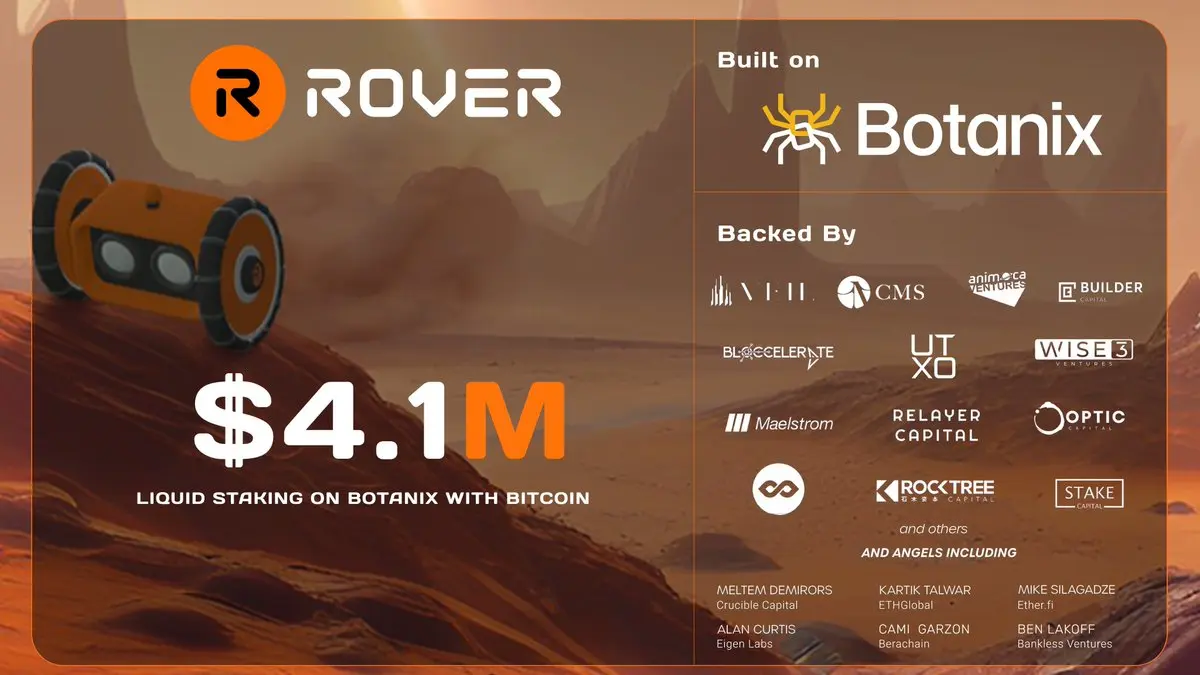

Many people don't know that the situation of "Large Investors in BTC's market capitalization + on-chain marginal people" has actually remained unchanged. For over a decade, it has never "really worked" on-chain—either the bridge is too centralized, or L2 is not grounded, or simply no one uses it.

1. But Botanix's Spiderchain is a bit different lately.

This architecture combines security, EVM compatibility, and BTC native features in such a seamless way for the first time.

Rover is one of the first projects to take off on this new L2.

Turned the originally stagnant BTC into active liquidity:

🔸

View Original1. But Botanix's Spiderchain is a bit different lately.

This architecture combines security, EVM compatibility, and BTC native features in such a seamless way for the first time.

Rover is one of the first projects to take off on this new L2.

Turned the originally stagnant BTC into active liquidity:

🔸

- Reward

- like

- Comment

- Share

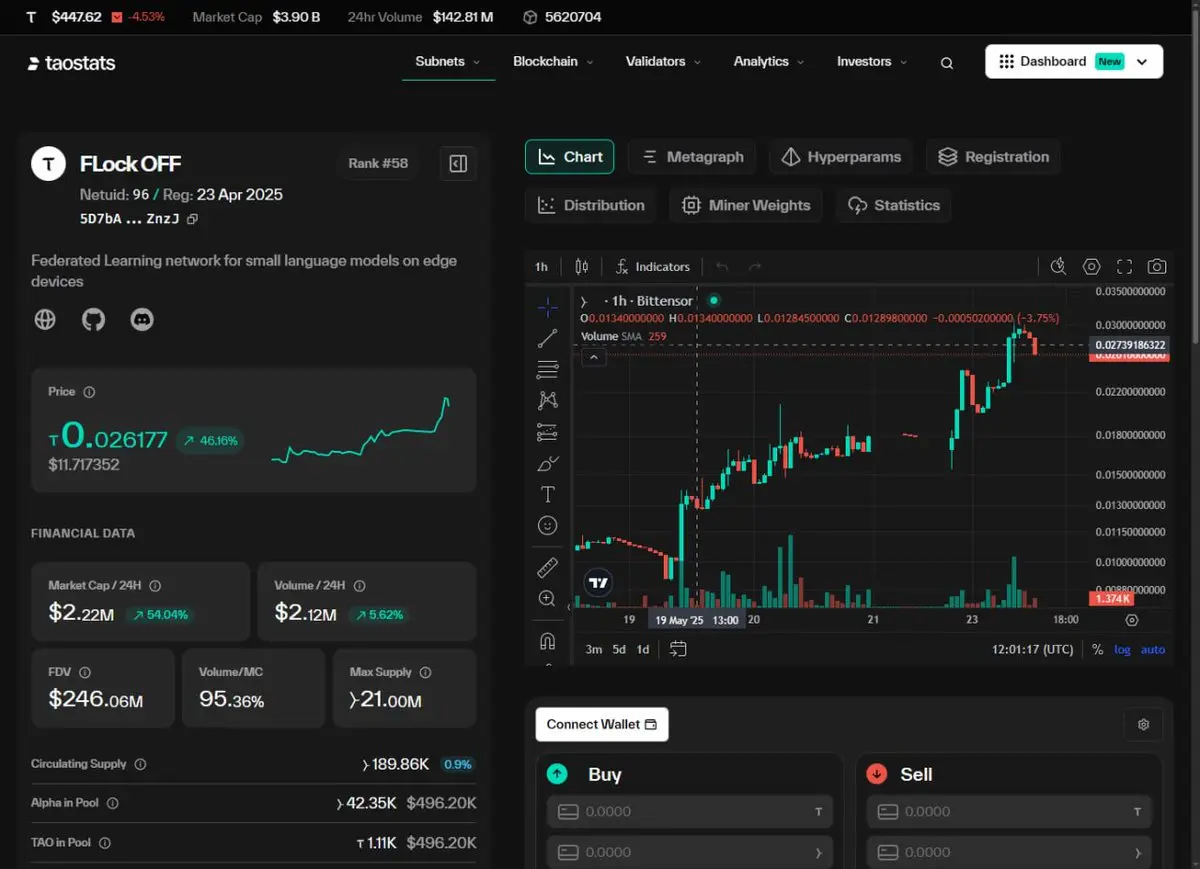

Recently, the TAO community has indeed been a bit quiet, with not many new projects to speak of aside from a few common old subnets.

But interestingly, the FDV of FLock's mainnet itself is only around 89 million USD. The FDV of the subnet is three times that of the mainnet, and this is only during the launch phase. Such a discrepancy is indeed rare in the TAO ecosystem.

From the perspective of positioning, SN96 focuses on on-chain data verification and task scheduling. It is currently the only subnet in the entire TAO that runs a full-link data screening + federated training closed loop. The t

View OriginalBut interestingly, the FDV of FLock's mainnet itself is only around 89 million USD. The FDV of the subnet is three times that of the mainnet, and this is only during the launch phase. Such a discrepancy is indeed rare in the TAO ecosystem.

From the perspective of positioning, SN96 focuses on on-chain data verification and task scheduling. It is currently the only subnet in the entire TAO that runs a full-link data screening + federated training closed loop. The t

- Reward

- 1

- Comment

- Share

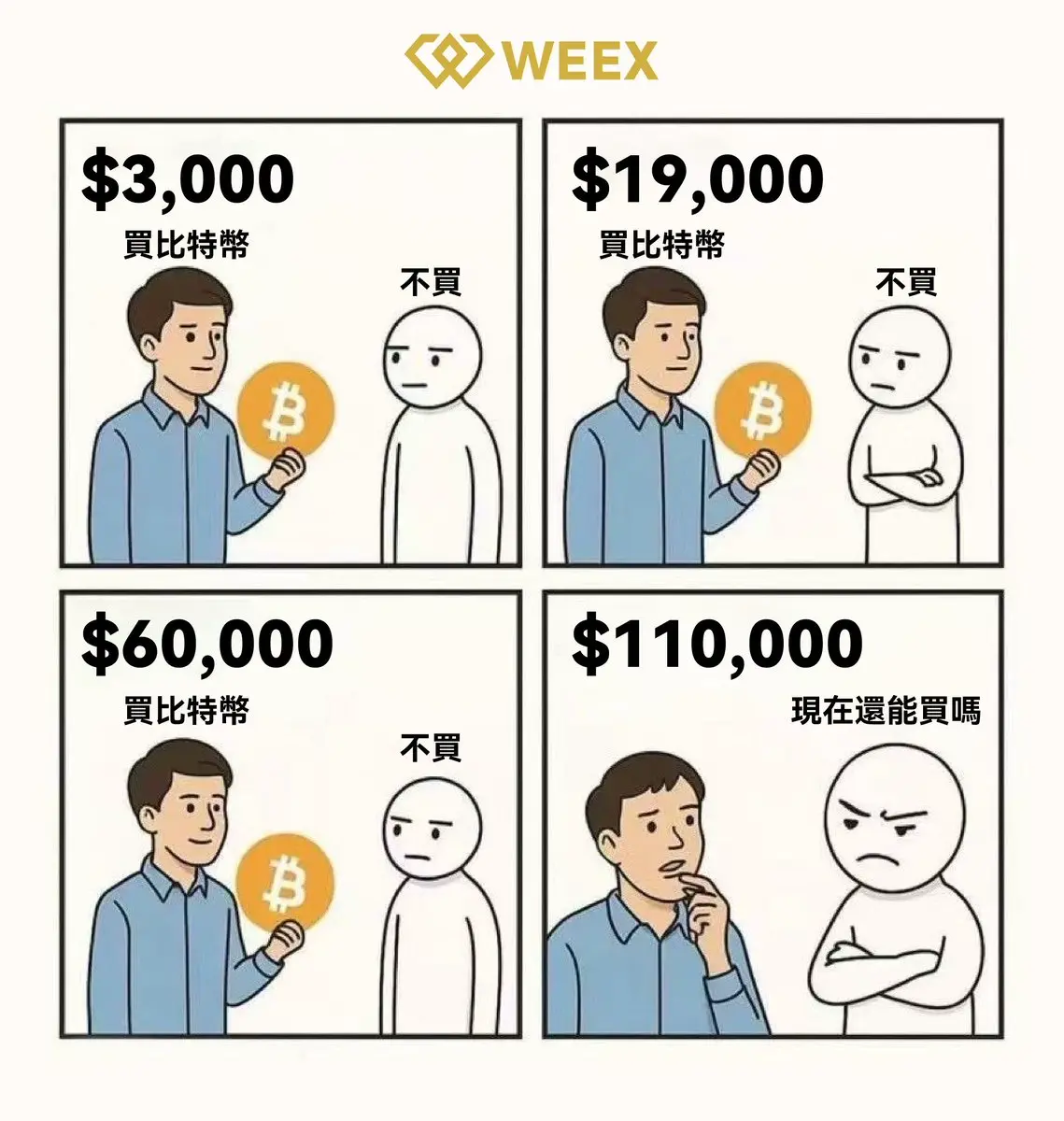

$3,000: Fake, Ponzi, do not buy

$19,000: Too expensive, not buying

$60,000: It's already risen so much, don't buy.

$110,000: Is it too late to buy now?

A complete set Don’t buy the trilogy + regret adding more 🐶

Next step: Start researching which platform can short Bitcoin 10x hahaha

$19,000: Too expensive, not buying

$60,000: It's already risen so much, don't buy.

$110,000: Is it too late to buy now?

A complete set Don’t buy the trilogy + regret adding more 🐶

Next step: Start researching which platform can short Bitcoin 10x hahaha

BTC1.36%

- Reward

- like

- Comment

- Share

Can the Token issued by Trump earn 300 million dollars just by lying around? 🧢

Since its launch, the creator of Meme coin #TRUMP has earned $320 million with a 0.3% transaction fee💰

It's all about everyone buying and selling to make money.

Others can earn money while lying down, but I'm just wasting time while lying down 🥲

Total supply of 1 billion, 20% released, 80% still locked, belonging to his company.

The fee structure does not depend on the coin price, but on the trading volume. If someone speculates, they will profit.

Interestingly:

The week the "dinner tickets" were announced, the h

View OriginalSince its launch, the creator of Meme coin #TRUMP has earned $320 million with a 0.3% transaction fee💰

It's all about everyone buying and selling to make money.

Others can earn money while lying down, but I'm just wasting time while lying down 🥲

Total supply of 1 billion, 20% released, 80% still locked, belonging to his company.

The fee structure does not depend on the coin price, but on the trading volume. If someone speculates, they will profit.

Interestingly:

The week the "dinner tickets" were announced, the h

- Reward

- like

- Comment

- Share